Most expats plan on or at least hope to retire early. But what savings or investment cushion do you fall back on post-retirement?

To make sure one can afford to stop working when he or she wants, there is a need to have thorough retirement planning in place.

Making the most of your retirement savings is crucial if you want to build a nest egg that will withstand the risks of inflation, market turmoil and your unexpected longevity. And for many expatriates this means creating and contributing to a pension plan.

(Expats are instead entitled to end-of-service gratuity in the UAE, which is calculated on the number of years one spends in service.)

But it has become evident that there are way too many expat pension options available out there as a result of major changes to international pension legislation over recent years.

A wider range of options brings greater complexity, which makes it vital you get the advice that’s right for you

A wider range of options brings greater complexity, which makes it vital you get the advice that’s right for you - before, at and during your retirement. This is why we look to disentangle the concept below.

A pension is simply a way of deferring some of your income now by putting some money aside for spending when you are older.

With that in mind, one should also be mindful of the leering risks that expats worldwide face when it comes to investing in retirement schemes.

One should also be mindful of the leering risks that expats worldwide face when it comes to investing in retirement schemes.

Expat problems with pension planning

Saving for retirement as an expatriate can be a challenging exercise, given that employees can be posted to several different countries throughout the course of their careers.

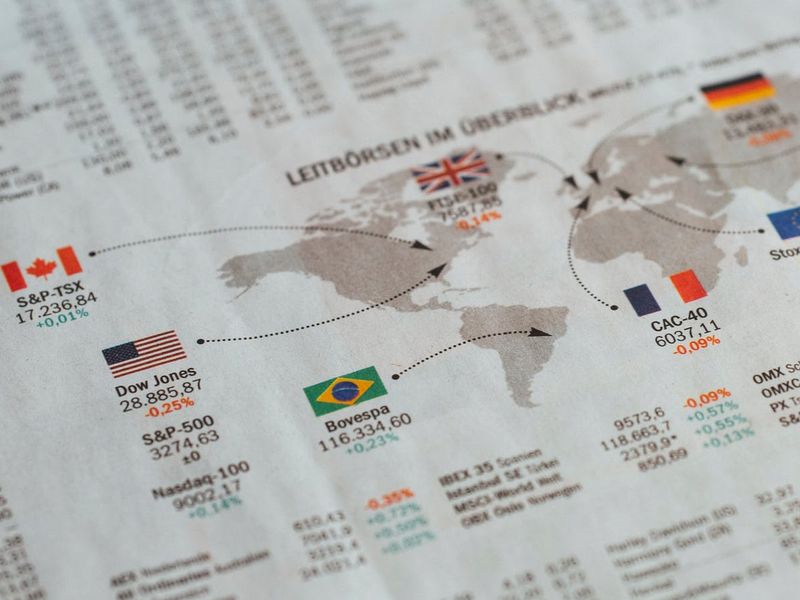

More often than not, each country has different pension fund legislation, coupled with diverse tax regimes.

More often than not, each country has different pension fund legislation, coupled with diverse tax regimes that act as barriers to the portability of pension funds.

While expat salaries tend to be at the higher end of the scale, very often the package does not include a pension scheme as this is not a statutory requirement in many countries.

So to continually start, stop and freeze a pension when you move will create a major headache and erode pension capital when it comes to retirement.

Specific schemes exist to help expatriates with their retirement planning requirements.

Real-life expat problems with pension planning

For many expatriates who are in the middle and lower income bracket, pension planning is very difficult.

Here are a number of factors that stand in the way

Those in the early stage of career with young families and school-going children saving potential is very low.

South Asian expats in particular have a cultural commitment to look after parents, younger siblings and relatives, thus a significant portion of their income goes for family maintenance.

Many pension schemes offered have penalty clauses for discontinuing or pausing the annual contributions.

All expats are not equal. The pension planning works only for the professional class with some surety of regular income.

These are a few issues an expat must face when considering a pension scheme.

Navigating an often complex world of expat pensions

To help better navigate the often complex world of expat pensions, it is vital to research and seek advice right from the start. So let’s not forget that not all schemes benefit everyone equally.

By opting a plan that is tailored to your specific situation, benefits can be availed irrespective of your situation - whether you're beginning your career or about to draw an income from your pension.

By opting a plan that is tailored to your specific situation, benefits can be availed irrespective of your situation!

Considering offshore pension plans

If you are considering retirement abroad, you may well be in a position to take advantage of offshore pension plans, and in so doing improve both the investment return and tax efficiency of your savings.

Such plans are an attractive option for internationally mobile employees or contractors working outside their country of origin. They are regulated by the authorities in the country where they are located.

Established offshore investment centres such as the Isle of Man with their independent legal, political and regulatory framework offer both tax efficiency and security to clients.

Offshore retirement planning is geographically portable; moving to different places around the world won’t affect your plan. The plan stays in the same place, all while growing tax-free in a tax-efficient investment area.

Key risks facing expats when opting for offshore pension plans

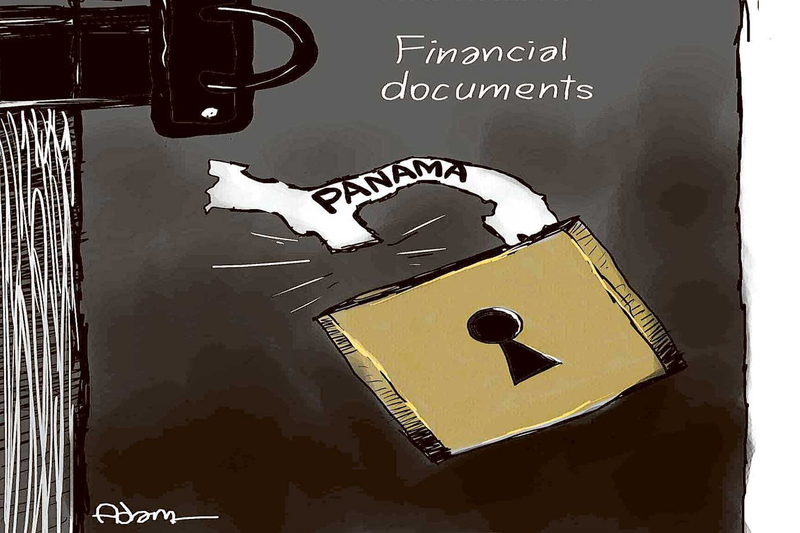

Many offshore offerings are, plainly put, con jobs masquerading as retirement schemes. Many expats have fallen victims to such scams, making them opt against offshore pension plans.

Many offshore offerings are, plainly put, con jobs masquerading as retirement schemes.

But attitudes are changing with tighter regulations in the offshore financial sector. Read the article below to find out how.

Another significant risk associated with the use of international retirement plans is that your money is invested directly on the world stock-markets by fund managers.

The value of the plan is not guaranteed and therefore can go up or down depending on the investment performance.

The point of a pension is to invest now so you have a big lump sum on maturity, both of which are designed to provide an income for you to live on when you retire.

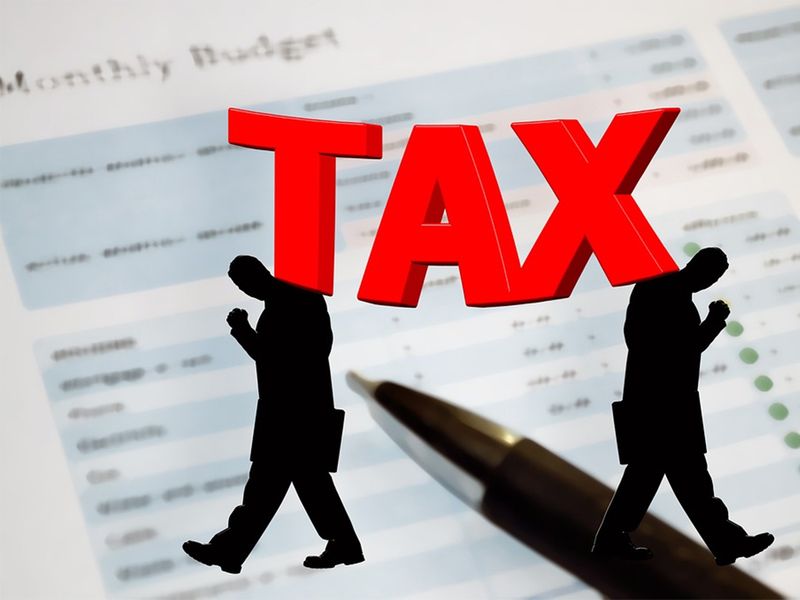

In the same way that compound interest or compounded returns produces superior returns on maturity, taxes paid every year produce inferior returns.

A good quality offshore pension investment will mean that you will have near-zero tax during the course of the policy.

A non-resident drawing an income from a pension elsewhere will have to pay tax on that income when back home unless they live in a country whose double taxation treaty has a pension-specific clause.

Now let's compare offshore pension plans against private pension schemes

It is an alternative to the state or government-run pension schemes. Usually, individuals invest funds into saving schemes or mutual funds, run by insurance companies.

Offshore pension plans are not the same as private pension schemes.

There is normally no minimum age to start drawing income in an offshore plan, or where there is it can be as low as 50. The retiree may be able to take possession of the entire asset in cash if need be.

There is normally no minimum age to start drawing income in an offshore plan!

Offshore plans have none of those above mentioned tax restrictions. Also when it comes to getting a big lump sum on maturity, it can be problematic when it comes to a private pension scheme.

With an offshore scheme you can withdraw 100 per cent tax-free, and typically you can withdraw the money when you wish, at a present maturity date, with no penalties.

As it acts like any other investment vehicle, you are free to move money about within it, change and adapt where your money is going and withdraw all of it upon maturity.

With an offshore pension, you have freedom and complete control.

Several other pension options to choose from

There are several other country-specific or company-specific pension options to choose from. Let’s discuss the most popular ones, before listing out what an expat should consider before opting for a plan.

For example some UK-centered schemes include QROPS and SIPP, which are increasingly popular among British expats.

Many British expats utilise QROPS because they offer multiple benefits such as currency and investment flexibility. In addition, there are tax advantages available to some expats.

Similarly, if you’re a non-UK resident with a pension in the UK, you may have come across an ‘International SIPP’.

SIPP stands for self-invested personal pension and is a type of UK pension plan that can be used to manage your pension benefits in the UK.

SIPPs generally give you greater flexibility and control over your pension than a standard company pension, and are useful for combining all your pensions into one place.

Through Overseas Occupational Schemes, expats who move to work abroad may be given the option of joining their employer’s occupational or workplace pension in their new country of residence.

If the scheme holder then relocated or repatriated, the funds held on their behalf in their former employer’s occupational scheme would remain overseas.

Official figures reveal over 31.8 million people, including NRIs, joined the tax advantaged scheme.

India’s Pension Fund Regulatory and Development Authority (PFRDA) recently allowed people of Indian origin holding citizenship of other countries, categorised as Overseas Citizens of India (OCI), to subscribe to the scheme.

Checklist: What to consider when pension planning?

Understanding what features are important specifically to you is vital in finding the right plan with regards to your pension.

These are some of the questions that an expat needs answered when considering a pension plan:

• Does the plan allow you to increase or decrease your premium payments?

• Is it possible for you to put a pause on your premiums payments?

• Is there freedom to choose a policy in the currency of your choice?

Understanding what features are important specifically to you is vital in finding the right plan with regards to your pension.

• Is it possible for you to pay your premiums by credit card or standing order?

• Is there freedom to reassess risk levels as you near retirement?

• Is it possible for you to assign beneficiaries to your policy for easy transfer?

• Is there an option for withdrawal of cash midway through the plan?

• Can you invest lump sums whenever possible to boost your pension?

Key takeaways?

For those seeking to retire abroad, it may be possible to take your domestic retirement plans with you.

But know your key expat pension options well. It’s important to understand how your pensions are paid and how retirement savings are affected if you retire abroad.

Retirement income can have several strands – the state pension, workplace or personal pensions, dividends on investments and interest on savings.

If you move your home to another county for good, your tax liability usually moves with you.

The general rule is tax is paid on worldwide income where someone has their main home as well as strong personal and financial ties.

Pension income is generally taxed where you live but tax is not paid twice on the same money in different countries because of double taxation agreements between the countries.

Moving abroad does not mean losing any retirement savings. The cash is safe sitting in a pension fund until you decide what to do with it.

Moving abroad does not mean losing any retirement savings.

The laws governing pension funds and taxation vary from country to country; these differences can limit the portability of pension funds and restrict flexibility for individual pension planning.

The situation can be exacerbated for expatriates with pension savings held in their home country denominated in a single currency such as Sterling USD or Euro. This can expose retirement income to currency exchange rate risks.

While keeping such risks in mind sought out a plan that bests suits your retirement savings target, while seeking assistance from an experienced financial planner.