Manila: While talk lingers on whether or not to open public utilities to 100 per cent foreign ownership by amending the 1987 Constitution (which imposes a cap of 40 per cent), three local tycoons have gone ahead to forge the “deal of the decade” in power generation.

The two-in-one project signed by Filipino billionaires – Ramon S. Ang (RSA) of San Miguel Corp, Sabin M. Aboitiz (SMA) of Aboitiz Power, and Manny V. Pangilinan (MVP) of Meralco PowerGen Corp. – covers a massive power generation deal yet unseen in its scale in the Asian country.

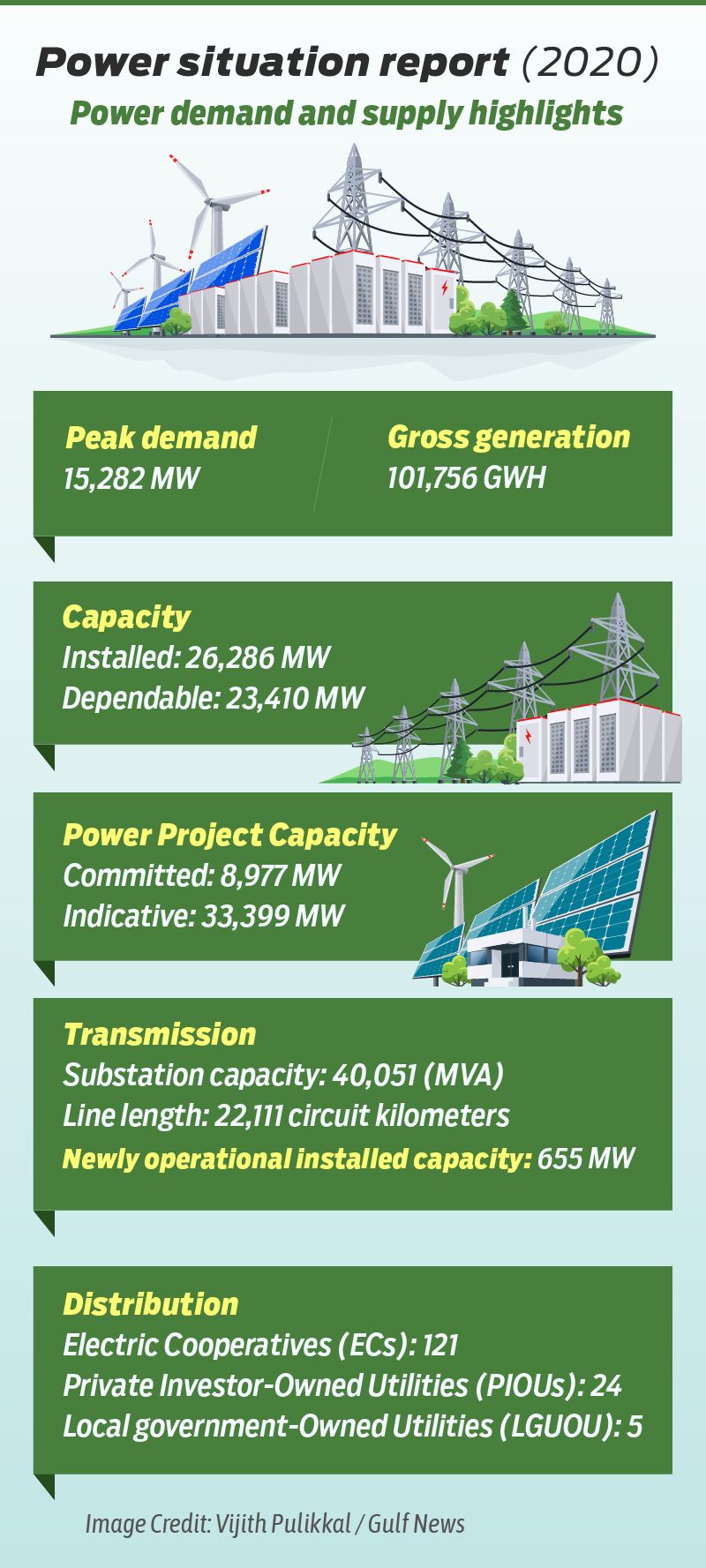

The Ilijan liquefied natural gas (LNP) power project is expected to produce an additional 2,500 MW power generating capacity, about 16 per cent of actual power demand in 2020.

Here’s what we know so far.

What is the project all about?

It is the country’s first integrated LNG project. Under the deal, Meralco PowerGen Corp. (MGen), Aboitiz Power Corp., and San Miguel Global Power Holdings Corp. (SMGP) have signed up to jointly work on the groundbreaking project, the biggest of its kind in the country.

It is an unprecedented move: three major power companies joining forces in a $3.3-billion (Php184.89 billion) initiative to establish the largest liquefied natural gas (LNG) facility in Batangas province.

The terminal is situated about 130km south of Manila.

$ 3.3 b

Total cost of the project entered into by SMC, Aboitiz and MeralcoWhy is this move significant?

It includes the acquisition of a liquefied natural gas facility, in the nation’s biggest energy transaction since 2008.

As per the agreement, MGen and AboitizPower will invest in SMGP's 1,278-megawatt (MW) Ilijan gas-fired power plant, along with a new 1,320-MW facility set for completion by year-end.

Together, the two projects would deliver a combined capacity of 2,599 MW.

15,282 MW

Peak total power demand in the Philippines (Source: DOE, 2020)Together, it adds nearly 10 per cent to the total installed capacity, and accounts for 16 per cent of peak demand, based on 2020 official data from the Department of Energy (DOE).

The tycoons agreed to acquire almost 100 per cent ownership of the LNG import and regasification terminal owned by Linseed Field Power Corp., a local subsidiary of global infrastructure firm Atlantic, Gulf & Pacific Co. (AG&P), which facilitated the country’s inaugural LNG cargo delivery in April 2023.

The infrastructure is designated to handle the reception, storage, and processing of LNG for the aforementioned power plants catering to Luzon’s main island.

This $3.3-billion LNG deal — bolstered by the financial sector's increasing appetite for big-ticket undertakings, a new era of bon homie and long-term strategic thinking shared by erstwhile competitors — could provide a template for future power projects, possibly including micro-hydroelectric power, in other areas.

Who is facilitating the deal?

Union Bank of Switzerland (UBS) AG, facilitated the financial aspects of the transaction, according to Manila Electric Co. (Meralco), a major power utility.

The LNG is regasified and burned by the power plants when needed.

Why does the Philippines need more energy?

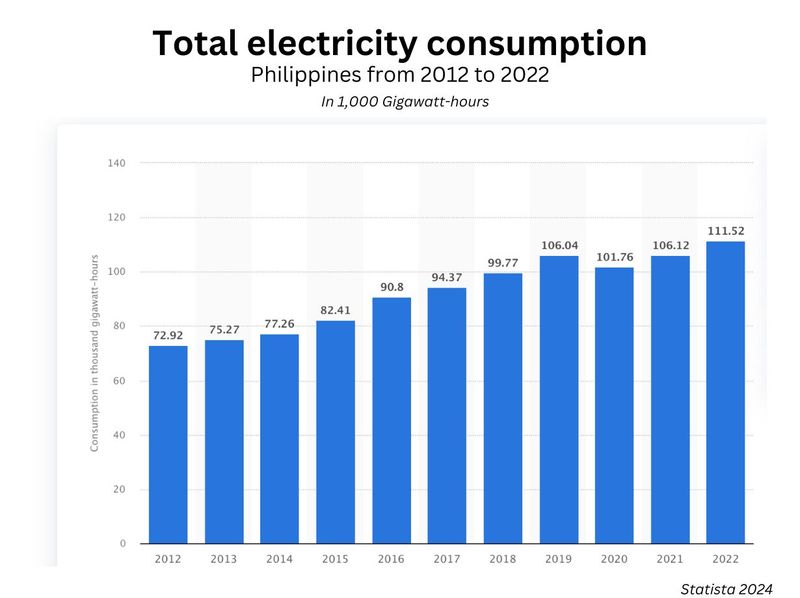

For years, except during the pandemic (2020 and 2021), energy demand has seen a steady rise in the country, which has aspirations to match the industrial prowess of its more advanced neighbours.

However, given the under-investment in power, entry barriers to foreign money, bureaucratic inefficiency, and high per kilowatt-hour rates, the country faces multiple challenges that need a whole-of-nation strategy to solve. Amending the Constitution's economic provisions is just the start.

For example, per capita electricity consumption (788.83 kWh in 2022) in the Philippines is less than a third of Thailand's, and only 1/12th of Singapore's. Higher power rates lead to less or no new job generation.

Filipino households and industries pay about 30 per cent higher for electricity than Asean neighbours. In Manila, the rate was Php12.05 per kilowatt-hour as of November 2023.

786.84 kWh

per capita electricity consumption in the Philippines, vs 1,926.1 kWh in Thailand; 2,450 kWh in Vietnam; 4,422 kWh in Malaysia; and 9,800 kWh in Singapore (Source: Enerdata, 2022)And unlike in most of its Asean counterparts, power in the Philippines is not subsidised.

Result: the Philippines finds itself competing with one arm tied, as very few investors in manufacturing locate their factories here.

The average factory consumes 9GWH of energy per year, of which 5GWH is thermal heat and 4GWH is as electricity, according to Thunder research consultancy.

Depending on the sub-sector (chemicals, food, electronics, machinery, etc), electricity can account for up to 30 per cent of manufacturing input.

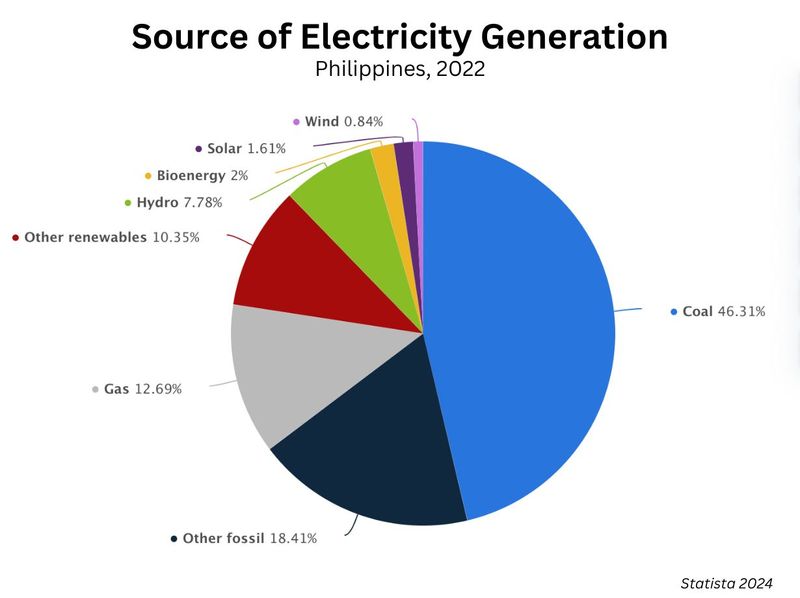

Recent data from the Department of Energy (DOE) also underscores the need to diversify the energy mix, with natural gas accounting for 13 percent of installed power capacity, and a significant portion still reliant on coal.

For years, the country has suffered from under-investment in power, due in part to the Constitutionally-set limits on foreign ownership, specifically of public utilities. And despite the abundance of geothermal and run-of-the-river hydro-electric power sources, the country today still mostly runs on coal. Nuclear power is nowhere.

This 2024, projections from industry experts indicate a 6.6 per cent growth in power demand, compared to the 17,000 MW in 2023. While the tycoons' deal would bolster the Luzon island grid, the Visayas and Mindanao grids could also similar undertakings, especially in renewables.

$ 337 b

estimated investments needed in the power sector in the Philippines to achieve clean energy goals by 2040 (Source: OECD | DOE)The $3.3-billion gas project is seen as part of a energy transition as it seeks to achieve a middle-income nation status and secure its energy needs.

In order to hit its clean energy goals, the Philippines would still need around $337 billion in investments by 2040, according to the “Clean Energy Finance and Investment Roadmap” prepared by the Organisation for Economic Co-operation and Development (OECD) along with the Department of Energy (DOE).

What does this deal mean for energy security?

For one, the mega gas deal is expected to help secure the nation's energy requirements while transitioning towards greener energy sources.

The surprise collaboration is seen as a huge stride towards a “more reliable and cost-effective” energy future for Filipinos, according to RSA.

Pangilinan, chairman of MGen, lauded the collaboration as a pivotal step in reshaping the Philippines' energy landscape and fostering sustainability.

It also aligns with the Manila’s advocacy for LNG as a transitional fuel amidst the country's renewable energy journey.

Sabin Aboitiz, chairman of AboitizPower, emphasised the importance of a balanced energy mix, highlighting the synergy between LNG and renewables.

For his part, AboitizPower President and CEO Emannuel Rubio, said: “Its importance in keeping the lights on cannot be understated.”

Not only will the project enable the company to diversify its generation portfolio, but also increase its capability in the delivery of energy security in the Philippines.

The current Constitution, now 38 years old (not once been amended) mandates a 40 per cent on foreign ownership of utilities – as well as media, advertising and education.

A hotly-debated issue among Filipinos pertain to Constitutional amendment to lift foreign ownership limits on key industries, improve the quality and affordability of services such as power and water.