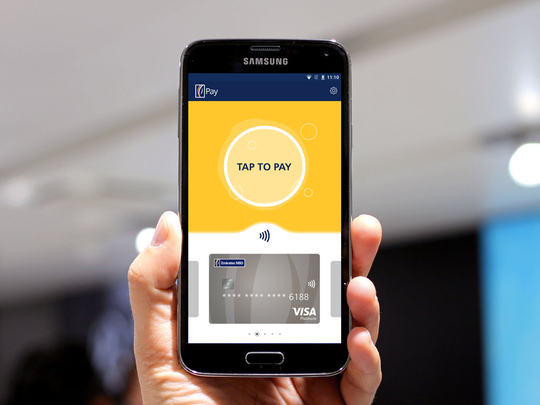

Emirates NBD, one of the leading banking groups in the region, has announced the launch of Emirates NBD Pay, a near-field communication-based mobile contactless payment service that enables customers to make in-store purchases instantly via their mobile banking app.

The bank, a front-runner in digital and mobile banking solutions in the UAE, is the first in the Central Europe, Middle East and Africa region (CEMEA) to incorporate Visa’s Token Service technology to launch a contactless payment solution.

Emirates NBD’s Visa credit and debit card customers can use their NFC-enabled Android mobile devices to make purchases at NFC-enabled point-of-sale terminals by upgrading their mobile banking app on the Google Play store to link the app to their credit/debit card. Once the merchant initiates the payment, the customer simply has to wave his/her smartphone near the terminal to complete the transaction instantaneously.

Commenting on the launch of Emirates NBD Pay, Suvo Sarkar, Senior EVP & Group Head – Retail Banking & Wealth Management at Emirates NBD said: “By being the first bank in CEMEA to sign up for Visa’s Digital Enablement Program in 2015, we have succeeded in launching Emirates NBD Pay in a short time frame. The service solidifies our commitment to adopting global best practices and introducing next generation banking solutions to the region. With total convenience and security being offered to our customers, we believe Emirates NBD cards will continue to be the preferred payment option for the market at large.”

Globally, all aspects of a customer’s lifestyle including music, email, ecommerce and payment are converging on the smartphone. Leveraging this trend, Emirates NBD Pay is leading the way to provide its customers with an in-store payment method using their mobile phones. Purchases made with Emirates NBD Pay are secure as Visa’s Token service technology replaces cardholder information such as account numbers and expiration dates with a unique digital identifier, or token that can be used for payment without exposing a cardholder’s personal account information.

Referencing the bank’s recent Dh500 Million investment to digitise the banking experience, Sarkar added, “We’re looking to redefine customer interactions with the bank – incorporating the Emirates NBD Pay application on our mobile banking platform allows us to further engage our customers and innovate for the future. With mobile ubiquitous in today’s world, innovation around mobile will continue to be a key area of focus for Emirates NBD.”

Selim Ergoz, General Manager, UAE, Qatar & Pakistan, Visa said, “We are very excited to work with Emirates NBD to make contactless mobile payment a reality for their customers. Consumers are ready for the next wave of digital payments with growing interest in using their smartphone to make payments. Visa Token Services is helping to accelerate the move to mobile, by bringing the added benefit of a new layer of security - without any additional friction - and also providing a secure foundation for previously unimagined ways to pay.”

The new launch is aligned with Emirates NBD’s commitment to digital innovation to make banking simple, secure and seamless.