Abu Dhabi: Abu Dhabi National Oil Company (Adnoc) is planning to deepen investment and partnership opportunities with Chinese energy firms as demand for energy and petrochemical products grows in the world’s top oil importer.

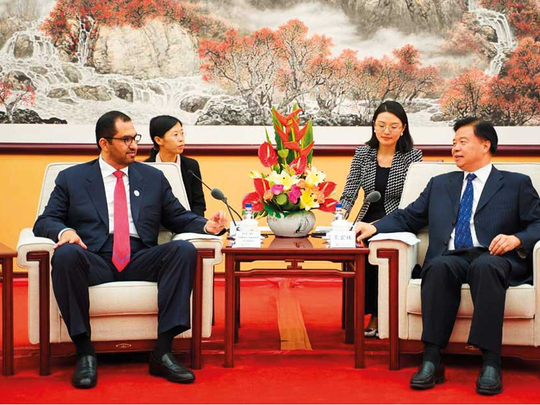

“Energy cooperation is an important aspect of the UAE’s relations with China, which is the number one oil importer globally and a major growth market for Adnoc’s crude, refined products and petrochemicals,” said Dr Sultan Ahmad Al Jaber, UAE Minister of State and Adnoc Group CEO, who was in Beijing to hold talks with top executives from Chinese energy firms.

“We are keen to expand and deepen that relationship and believe there are mutually beneficial partnership and co-investment opportunities across our upstream and downstream value chains. Adnoc is also ready to work with its existing and potential new partners to meet the growing demand for energy and petrochemical products in China.”

Al Jaber held a series of meetings with Chinese oil, gas, refining and petrochemical industry leaders during the visit and highlighted various opportunities for Chinese firms to invest in the UAE’s oil and gas exploration and downstream operations.

Adnoc is making significant investments in new downstream projects, both domestically and internationally, to grow its refining capability and expand its petrochemical production three-fold to 14.4 million tonnes per annum by 2025.

Planned projects include a state-of-the-art mixed liquid feedstock Naphtha cracker, as well as investments in new refinery capacity.

As a result of the planned expansions in its downstream business, Adnoc will create one of the world’s largest integrated refining and petrochemical complexes at Ruwais, located in Abu Dhabi’s Al Dhafra region.

The company is also allowing competitive bidding in six offshore and onshore exploration, development and production blocks to boost production capacity.

“The release of the six blocks for competitive bidding represents a rare and exciting opportunity to invest in the UAE’s stable and secure exploration and production sector, as we accelerate delivery of a more profitable upstream business and generate strong returns for the UAE,” he added.

The UAE and China have a number of partnerships in the UAE’s energy sector, starting in 2014, when Adnoc and CNPC (China National Petroleum Company) established the Al Yasat joint venture.

More recently, in February 2017, CNPC and China CEFC Energy were awarded minority stakes in the UAE’s onshore oil reserves and in March of this year, CNPC, through its majority-owned listed subsidiary PetroChina, was granted a 10 per cent interest in each of the Umm Shaif and Nasr and Lower Zakum offshore concession areas.