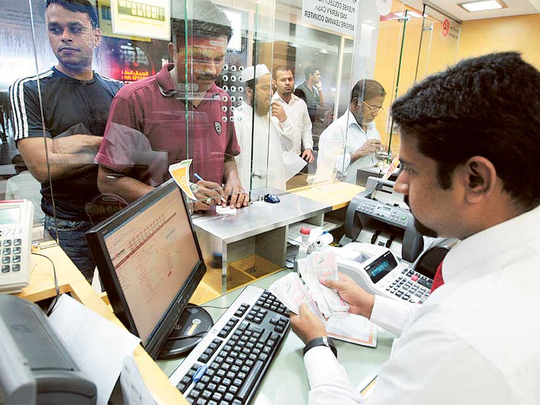

Dubai: UAE-based expatriates from South Asia continue to enjoy the cheapest rates when transferring money home, but many of them are seeing an increase in costs, according to the latest official figures.

The Remittance Prices Worldwide, published by the World Bank, shows migrants from Bangladesh, predominantly semi-skilled workers, now have the best opportunities for moving funds at a very affordable cost.

Transferring money from UAE to the Asian state costs just Dh15.01 for every Dh735 sent as of March 2018. That’s a huge drop from Dh21.73 a year ago, thanks partly to service providers lowering their exchange rate margins on transactions in the UAE-Bangladesh corridor.

India, which received the biggest chunk of global remittances last year at Dh253 billion, is the second cheapest country to send money to, followed by Sri Lanka and the Philippines in the third and fourth place, respectively.

ALSO READ: Indians enjoy windfall as rupee plummets

The average cost for sending money to India, however, went up to Dh23.89. Rates for remittances to Sri Lanka and the Philippines, which received nearly Dh2 billion from overseas Filipino workers (OFWs) in UAE in 2016, also rose to Dh27.32 and Dh28.16, respectively.

Rates for transferring money to Pakistan, recently saddled with dwindling foreign exchange reserves, are the fourth lowest and have have also increased from Dh21.63 last year to Dh 29.01 this year.

5 Cheapest places to send money to from UAE

(Average cost per $200 transfer)

1.Bangladesh: Dh15.01

2. India: Dh23.89

3. Sri Lanka: Dh27.32

4. Philippines: Dh28.16

5. Pakistan: Dh29.01

Expats from Indonesia and Sudan, however, are paying the highest rates, at D50.69 and Dh45.94, respectively.

There is an ongoing campaign to reduce the cost of money transfer for foreign workers, especially those originating from developing countries. As part of this, the World Bank regularly tracks the total cost of forwarding funds, including the service fees and exchange rate margins charged by exchange houses and banks on transactions worth $200 (Dh735) and $500 (Dh1,835).

Average cost of money transfer from UAE to other select countries:

Egypt: Dh29.27

Nepal: Dh33.08

Yemen: Dh41.68

Jordan: Dh44

South Sudan: Dh45.94

Sudan: Dh45.94

Indonesia: Dh50.69

While money transfer charges have increased for some expats, the UAE still offers some of the best rates in the world.

“[The] UAE is among the most cost-effective countries for sending money internationally. [While] the global average cost for sending money transfers is 7.32 per cent, which means that it costs $7.32 for sending $100, the cost of sending money from the UAE is less than 2 per cent,” Sudhesh Giriyan, COO, Xpress Money, told Gulf News.

However, transfer rates tend to be cheaper for certain corridors, as market players have the tendency to bring the costs down, including exchange rate margins, due to factors like competition.

“The lower cost of money transfers to South Asian nations is a reflection of the competitive landscape with existence of multiple service providers,” explained Giriyan.

“There are other regions of the world where the competition is very low owing to exclusive arrangements between service providers which is a major barrier in reducing the cost of money transfers.”