Huawei and 11 other leading electric vehicle manufacturers in China including BYD, GAC and GWM have spearheaded a “supercharge alliance”, in an unprecedented industry move.

The shift aims to ease customers’ confusion and frustration over disparate charging standards by moving to a common form factor and specification for the member-carmakers in the world's biggest auto market.

The move comes within weeks of the rollout of the Luxeed S7 electric sedan, developed by Chinese tech giant Huawei and Chery Auto. The Shenzhen-based company said thousands of new charging stations will be installed via joint efforts of its members.

Who are the alliance members?

They’re are some of the nameplate EV makers in China, where 8 million new plug-in vehicles were registered in 2023:

- Avatr Technology,

- BAIC Group,

- BYD,

- Chery,

- Cyrus,

- Hozon Auto,

- Li Auto,

- Great Wall Motors,

- GAC Group, and

- JAC Motors,

- Nezha Motor,

- Seres Group (Huawei's car-making partner), and

- Xpeng Motors.

Notably, Nio (which promotes its battery swapping technology) was not part of the initial alliance.

What’s the effect of this move?

It’s a strategic move among Chinese EV tech firms to catalyse the industry's acceleration – sort of like how the standardisation of smartphone charging (i.e. USB-C) has allowed the manufacturers to innovate and grow around it.

What is “SuperCharge”?

Huawei’s stated goal is to accelerate the development of high-quality charging infrastructure, with a focus on “super-fast charging” capabilities.

According to Hou Jinlong, director and president of Huawei Digital Power, this collaborative effort will allow car manufacturers to focus on enhancing the competitiveness of their electric vehicles, thereby promoting the growth and widespread adoption of EVs.

How many SuperCharge stations are installed?

With over 20,000 super-fast charging stations already operational in China, Huawei has stated it is committed to leading the advancement of electric vehicle infrastructure.

Huawei has also revealed its ambitious plan to deploy over 100,000 “SuperCharge” charging stations across China before 2024 is out.

This marks a significant step towards enhancing EV infrastructure in the mainland.

What does the “supercharge” alliance mean?

Standardisation efforts often involve collaboration among partners to address emerging challenges – or incorporate new technologies.

It also promotes harmonisation of regulations, enabling companies to access global markets more efficiently and cost-effectively.

Having common standards can help ensure compatibility, interoperability and compliance with regulations across different markets, spur further industry growth, curb trade barriers and simplify cross-border transactions.

In certain jurisdictions, it’s the regulator that mandates standardisation, in the case of USB-C mandate made by numerous countries, including the EU, Saudi Arabia and India.

How would the standardisation in charging affect the EV industry?

Some of the obvious benefits: Standardisation involves defining specifications, guidelines, and best practices – which help ensure consistent quality across products and services.

Customers can then expect adherence to established standards. This pushes companies to improve product reliability, reduce defects, and enhance customer satisfaction. This, in turn, can stabilise and bolster the industry reputation as a whole.

With economies of scale, it also leads to increased efficiency in production and distribution.

Moreover, by adhering to common standards, companies can reduce costs associated with customisations and ensure smoother interactions across the supply chain.

While standardisation aims to establish common practices and specifications, it can also foster innovation within the industry.

What is the Huawei-led charging format?

It’s not clear at this point, though Huawei is known for its AI-based “flash charging”. The company is behind the 4C and 2C charging.

Li Auto announced that its App's charging map will soon have access to 200 Huawei supercharging stations, “gaining access to about 400 4C superchargers and 2,000 2C fast chargers”, the company announced on Weibo.

“C” refers to the charging multiplier, and 4C means in theory that a vehicle can be fully charged in a quarter of an hour, although charging speeds are also limited by the vehicle's electrical system.

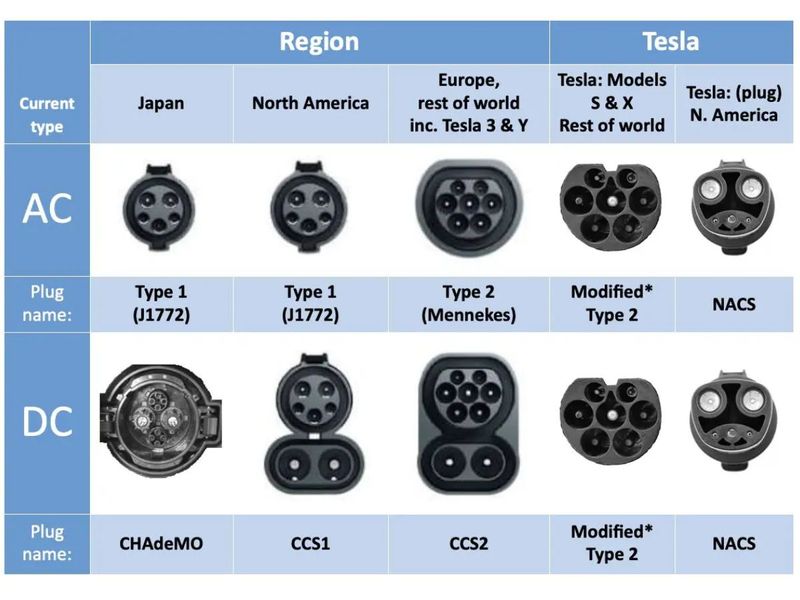

What is the standard EV industry charging system?

There is no standard or state-mandated charging system.

Currently, the de-facto standard is North American Charging Standard (NACS). Popularised by Tesla, NACS has been adopted by Stellantis (maker of Jeep, Ram and Chrysler), Ford, GM, Mercedes-Benz, Nissan, Honda, the Hyundai Group, Toyota, BMW, Volkswagen, Lucid, among others.

It’s not clear if the Huawei-led alliance will adopt NACS, implement its own, or use both using an adopter.

With the majority of industry players embracing this standardisation, it is anticipated that by 2025, most vehicles will have access to a broader network of charging stations.