What do you do if you’re a historically unpopular new president, with a record low approval rating by 14 points, facing investigations into the way Russia helped you get elected, with the media judging your first 100 days in office as the weakest of any modern president?

Why, you announce a tax cut!

READ MORE:

Why tax cut may not deliver the boost White House promises

Trump surprises with tax reform announcement

Tax plan is far too vague

And in your self-absorbed way, you announce a tax cut that will hugely benefit yourself. Imagine those millions saved! You feel better already!

I’m deeply sceptical that United States President Donald Trump will manage to get a tax reform package passed into law, and that’s just as well. Trump’s new tax “plan” (more like an extremely vague plan for a plan) is an irresponsible, shameless, budget-busting gift to zillionaires like himself.

This isn’t about “jobs”, as the White House claims.

If it were, it might cut employment taxes, which genuinely do discourage hiring. Rather, it’s about huge payouts to the wealthiest Americans — and deficits be damned!

Betrayal of his voters?

If Republicans embrace this “plan” after all their hand-wringing about deficits and debt, we should build a Grand Monument to Hypocrisy in their honour.

Trump’s tax “plan” is a betrayal of his voters. He talks of helping ordinary Americans even as he enriches tycoons like himself.

For example, it’s great that the tax plan promises help with child-care costs, a huge burden for low-income families, especially single mums. But Trump doesn’t explain what form his help will take.

Maybe he will eventually provide details, but in his campaign tax plan (which overall seems similar to the latest), fewer than 10 per cent of low-income households with children would get anything at all, according to a study by the nonpartisan Tax Policy Center in February.

It added that under the campaign plan, families earning between $10,000 (Dh36,780) and $30,000 a year would receive an average child care benefit of just $10.

In fairness, Trump’s proposal does include some sensible elements. Raising the standard deduction is smart and would simplify everything, reducing cheating and the need for record-keeping because millions of filers would no longer itemize deductions.

But the heart of Trump’s “plan” is to lower taxes for corporations and the affluent. It would eliminate the alternative minimum tax, without which Trump would have paid less than 4 per cent in taxes for 2005; with it, he paid 25 per cent.

Conservatives emphasise that the official top corporate tax rate in the US is too high, and they have a point. The top rate for American corporations — almost 39 per cent, including a 35 per cent federal rate and a bit more for the average state rate — is among the highest in the world, according to the Tax Foundation.

Yet, that’s deeply misleading, because most companies don’t pay that rate. The Government Accountability Office found that two-thirds of active corporations paid no federal tax.

Large corporations paid 14% tax

Even large, profitable corporations paid an average federal rate of only 14 per cent — and Boeing, Verizon, General Electric and Priceline paid no federal income tax over a five-year period, according to Citizens for Tax Justice.

There’ve been many studies showing that the US effective marginal rate for corporations is in the same ballpark as in other industrialised countries (some say it’s a bit lower, others a bit higher).

So, sure, let’s lower the official corporate tax rate while reducing loopholes, but don’t pretend this will create a ton of new jobs.

Where the tax plan would have a big impact is in empowering some very wealthy people, because of another bit of chicanery in the proposal: Trump apparently would allow some business owners to dodge personal income tax by paying at the much lower corporate rate.

In other words, tycoons would try to structure their incomes to pay not at a 39.6 per cent top personal rate, but at a 15 per cent corporate rate.

This isn’t tax policy; it’s a heist.

Then there’s the elimination of the estate tax. The White House talks solemnly about protecting family farms and other businesses, but give us a break! The estate tax now affects only couples worth more than $11 million.

About one-fifth of 1 per cent of Americans are affected — but the estate tax does limit the rise of inequality and assures a hint of fairness, since much of the wealth in rich estates has never been taxed at all.

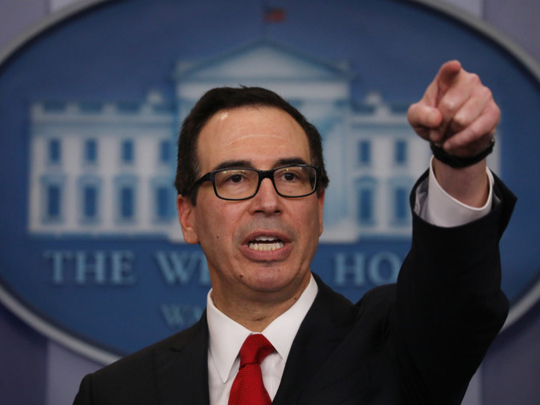

US Treasury Secretary Steven Mnuchin says Trump’s tax “plan” would be paid for partly “with growth” — which means that he has no idea how to pay for it.

The Tax Policy Center examined Trump’s campaign tax plan and found it would cause the federal debt to rise by at least $7 trillion in the first decade, and more than $20 trillion by 2036 — slowing growth, not raising it. To put the latter number in perspective, that’s additional borrowing of about $160,000 per American household.

Effectively, America would borrow from China or other countries to finance huge tax breaks for Trump and his minions. And this is populism?

— New York Times News Service

Nicholas Kristof is an American journalist, author and a winner of two Pulitzer Prizes.