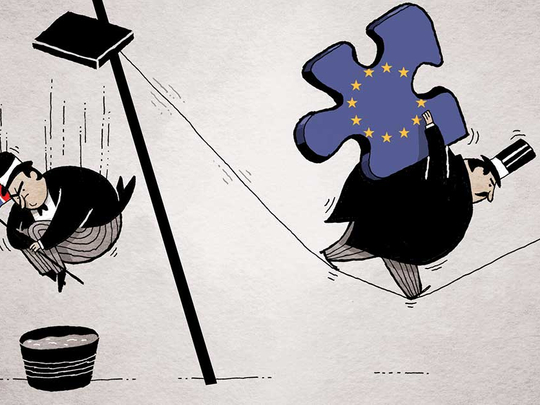

The British vote to leave the European Union (EU) may come to be seen as a tipping point in global politics, perhaps more consequential than anything since the fall of the Berlin Wall. It may mark the moment when Europe comes face to face with its own constitutional dysfunction, when the idea of the “West” finally ceases to be plausible and when the United States is confirmed in its sense that its interests lie more in Asia than in its traditional Atlantic sphere of influence.

The shock of the referendum will be felt initially in Britain. In politics, Prime Minister David Cameron has already announced he will be going, but in an agonisingly slow way. The business of replacing him requires a two-stage vote, one by Conservative members of parliament and the next by rank-and-file members of the Conservative Party. This process will drag into the autumn. In the meantime, the country will be led through its crisis by a lame duck.

Even once a new leader is chosen, that leader will either be a Brexiteer, in which case he or she will be at odds with a majority of parliament — and therefore vulnerable to a vote of no-confidence, which could trigger an early election. Alternatively, the new leader will be a Remainer, in which case, he or she will be at odds with the outcome of a referendum in which fully 72 per cent voted. Nor is the situation going to be stabilised by other political developments. There is talk that the Labour Party may seize this moment to defenestrate its leftist leader, Jeremy Corbyn. The Scottish National Party has already predicted a second referendum on independence from the United Kingdom.

There will be consequences for financial markets, both in Britain and abroad. Already, the British pound and the London stock market have been hammered, anticipating the recession that is likely to come. So-called “safe haven” currencies are rising: The Japanese yen, the Swiss franc, the US dollar. For all these economies, stronger currencies mean weaker exports and lower inflation. Do not expect the Federal Reserve in the US to tighten soon. In Japan, Prime Minister Shinzo Abe’s attempt to rescue his country from terminal stagnation has just suffered a mortal blow.

But the largest consequences will be for Europe — both for the reality and the idea. Britain’s vote will encourage populists elsewhere: Already, Eurosceptics in Sweden, France and the Netherlands have demanded a copycat referendum. Polls suggest that French voters are more sceptical of the EU even than British ones, a sentiment that will assist the far-right populist, Marine Le Pen, in next year’s presidential contest. Populist governments are already in power in Greece, Hungary and Poland. The fear that Europe’s cohesion is weakening could reignite economic turmoil in the Eurozone. Government bonds in Spain and Italy look riskier now that the continent’s cohesion is in doubt.

In an ideal world, the Brexit shock would galvanise Europe into a muscular response. To borrow an analogy from the 2008 financial crisis, if last Thursday’s vote was something of a “Lehman moment”, then we should all wish for the next steps to resemble the fast rescue of AIG and the passing of the TARP bailout plan. In other words, a determined commitment that no more dominoes should fall. But Europe’s problems are too deep, and its leadership too fragmented, for this vigorous response to appear probable.

The project of European integration can be thought of as three experiments in the management of globalisation. The first is a triumph: The single market for trade in goods and services spurs competition and efficiencies in a bloc of more than 500 million people. The second experiment is a mixed story: The commitment to free movement for students, workers and retirees across 28 countries has expanded individual freedom and prosperity but is politically unpopular. Meanwhile, Europe’s third experiment is a disaster. The creation of the euro, the shared currency now used by 19 EU countries, was quite simply a bridge too far.

But what is the way back? Once a country has given up its currency and denominated every contract in euros, the prospect of exit is too awful to contemplate. Greece has gone up to the brink on more than one occasion; each time it has decided not to jump. Yet, if the euro’s dissolution would be prohibitively traumatic, the further integration required to sustain a common currency is equally daunting. Nations in the Eurozone need to coordinate their taxing and spending. They must be prepared to transfer large chunks of federal revenue from rich regions to poorer ones — as happens within the US. Given the Euroscepticism revealed by the Brexit vote, none of this is on the cards.

Over the coming days, leaders need to reaffirm their commitment to stability. Germany could cushion the economic shock by promising a tax cut; it should refrain from criticising the European Central Bank as it ramps up extraordinary monetary measures. France, Italy and other powers should pledge a quick and reasonable divorce from Britain so that crippling uncertainty is not prolonged. The US, for its part, should demonstrate its commitment to Nato. After the Brexit vote, there will be doubts as to whether Britain will really come to the defence of a fellow Nato member such as Poland. The US needs to step forward or see Nato’s credibility crumble.

With luck, statesmen on both sides of the Atlantic will rise to this challenge — and my dire warnings of a tipping point in history will turn out to have been wrong. But we are not at a moment when statesmanlike vision is abundant. Continental European leaders have their own domestic populist challenges to worry about; they are not in the mood to be generous to their neighbours. As for the US, the mood is not exactly internationalist. Donald Trump has lost no time in celebrating Britain’s awful vote.

— Washington Post

Sebastian Mallaby is a senior fellow at the Council on Foreign Relations and an editor at InFacts.org, a website that campaigned to keep Britain in the European Union.