Dubai: Property pundits posit Dubai’s residential rental rates will go even lower in 2018 as cash-strapped tenants opt to relocate to cheaper new digs or haggle with existing landlords to trim rental costs.

With upwards of 20,000 new residential apartment units expected to arrive on the Dubai skyline in the new year, supply and demand pressures will push rents even lower, suggests statistical analysis by seasoned property consultancy firms.

The downward trend comes close on the heels of a 12 per cent drop in rental prices across Dubai this year.

While market professionals waited for a price correction in mid-2017 that never materialised, experts tell Gulf News that a growing number of landlords are now resigned to a protracted price slide evidenced by more tenants succeeding in securing monthly rent savings.

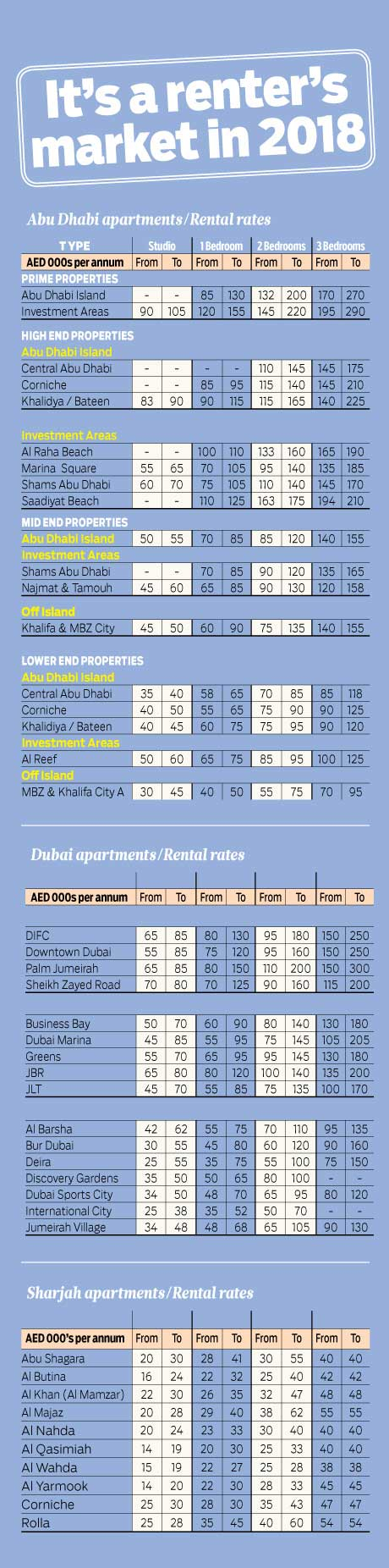

In its latest third quarter UAE Real Estate Report, property firm Asteco noted that “yearly changes were nominal with decreases of 4 per cent on average across all quality bands. Business Bay and Dubai Marina led the price declines with a drop of 8 per cent, followed by Dubai Sports City, International City and Jumeirah Village at 7 per cent.

Dubai: Biggest rent declines

Dubai Marina: 19%

Downtown Dubai: 18%

Bur Dubai and Sports City: 16%

Jumeirah Village / Deira: 15%

Source: Asteco third quarter 2017 report

“Rental rates softened by 4 per cent over the quarter. Whilst this was less pronounced than projected, the annual change since Q3 2016 amounted to 12 per cent, which can be largely attributed to increased supply,” the firm stated.

“Despite increased government spending in infrastructure, hospitality and retail in the run-up to the Expo 2020, market sentiment remains low largely due to the bearish outlook in terms of oil price and global economic recovery,” the report stated.

Keeping tenants

In an interview with Gulf News, Asteco managing director John Stevens said the rental market for flats would appear to have some way to go before correcting itself towards higher prices and believes rents will continue to slide somewhat into at least the first quarter of next year.

“I think, realistically, you have to think rents are still going to drop,” said Stevens. “In terms of the rental market, I would say the market has not bottomed out.”

With an additional 14,000 units handed over in 2017 in Dubai, more supply has opened housing stock making tenants spoilt for choice.

More choice in the market also means lower rental rates and as more tenants approach the time in the new year to renew their rent renewal contracts, “most people are getting rent reductions”, Stevens said.

Smart landlords are realising that it is better to keep a tenant than face vacancy periods of months at a stretch and losing money, he said, noting “there is an element of chasing the market down for keeping tenants. People will move for a few thousand dirhams”.

The hardest-hit sector for property owners leasing out their apartments is in the high to luxury end segment of the property market, Steven said.

Biggest rent declines as recorded by Asteco in the third quarter were in Dubai Marina and Downtown Dubai at 19 per cent and 18 per cent, respectively.

In the affordable range of properties in Dubai, the biggest drops in rent prices were observed at 16 per cent in Bur Dubai and at 16 per cent in Sports City and at 15 per cent in Jumeirah Village and Deira.

The secret to keeping rental properties at full vacancy during the deepening price slump would appear to be keeping rental rates attractive for what’s on offer, Stevens said.

“In Dubai, in all honesty, if it’s priced right, it will rent,” he said, adding that tenants are much more informed than ever before with a slew of online property-related websites to compare listings and area rentals.

The new Dubai Land Department’s rental index [https://www.dubailand.gov.ae/English/Pages/rental-increase-calculator.aspx], for example, allows visitors to its website to search each area of the city for do some comparison shopping for leasehold properties.

Jesse Downs, managing director of Phidar Advisory, told Gulf News that all signs now point to the rental market experiencing reduced rates for the short term.

- Jesse Downs | Phidar Advisory

“I think rates are going to keep declining over the next year at least. What we are experiencing is a return to sanity,” said Downs, who agreed that cautious investors in a weaker economy combined with slowed employment growth and incoming supply are mitigating factors.

Downs said that the rental market correction now at play has long been coming after years of runaway increases where rents were increasing by 30 per cent.

The latest market correction has seen rents level off to rates that are more realistic, she said.

With a renters’ market, “it could present a good time to move within the next year. Tenants are moving to new buildings with better quality and better price”.

Downs said landlords were holding on up until late summer hoping for the market to turn around in their favour but saw the writing on the wall and started agreeing to rent reductions.

“There has been this obstinancy on their part … but there was no recovery this summer,” Downs said.

Asked to speculate as to the scope of a further slide in rental prices in the new year, Downs said the Dubai market could see a double-digit decline in a continuing trend ahead.