Dubai: The total number of students in schools and universities in the UAE is projected to grow by 4.1 per cent annually until 2020, making the UAE’s education sector one of the fastest growing in the region, a GCC Education Industry Report unveiled on Monday said.

Published by Alpen Capital, the report said the country has the highest number of international schools. The report showed a steady growth in the GCC’s education sector covering pre-primary, primary, secondary, and tertiary and vocational segments across UAE, Qatar, Bahrain, Saudi Arabia, Oman, and Kuwait.

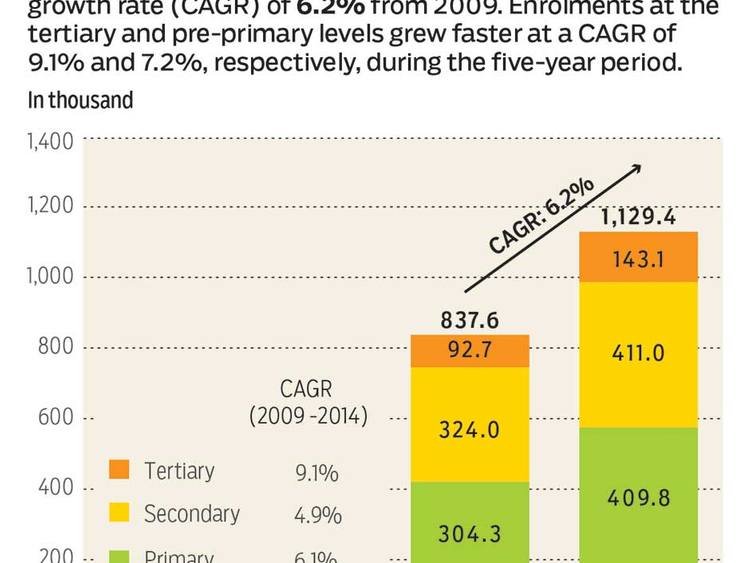

Expected to grow faster than the GCC average, the total number of students in the UAE is predicted to increase from an estimated 1.1 million students in 2015 to 1.4 million in 2020. The faster growth is due to the expansion of primary and tertiary education, facilitated by the growth of private schools and the government’s focus on higher education, said Mahboob Murshed, managing director, Alpen Capital.

While the UAE and Qatar have both remained at the forefront in attracting private investors to the education sector, the UAE has the highest number of international schools in the world (511). International schools are popular in the GCC due to the large presence of expatriates, along with the desire of citizens to send their children to institutions offering high quality education.

The UAE provides a “favourable investment climate” by offering land for free or at attractive lease terms and financial support in the form of grants, student vouchers, and subsidies.

Increase in private schools

In private schools, the report said, the number of students is expected to rise at a rate of 4.3 per cent annually during the five-year period (2015-2020), faster than nearly two per cent for public schools. “In 2016-2017 alone, around 20 private schools are expected to open in Dubai, and 17 private schools in Abu Dhabi by 2018,” said Murshed.

When it comes to higher education, Dubai has become a major education destination, as it accommodates several overseas students, a large number of whom are from the Arab region, said Murshed.

Government strategies

The UAE was ranked 12th and 13th based on the parameters of equality of higher and primary education in the 2015-2016 Global competitiveness report. The report showed that the quality of education is reflected in the existence of renowned schools and colleges in the country, including names like GEMS, SABIS, London Business School, and New York University of Technology.

However, the UAE government also has a major role to play in the growth of the education sector.

The GCC Education Industry report showed that despite a budget cut because of falling oil prices, the UAE education sector received the highest allocation of the 2016 budget.

The UAE‘s Ministry of Education has also developed a ten-year strategy (2010-2020) aimed at improving student outcomes and school life, providing access to affordable and high-quality education.

Smart education has also been implemented through the digital education initiative, the Mohammad Bin Rashid Initiative for Smart Learning. The project is set to introduce smart classes across all schools and facilitate a modern learning environment by providing tablets and high-speed 4G networks by 2017. Within two years of its implementation, the programme has covered 800 classrooms across 146 schools.

Statistics

The GCC education sector is projected to reach 15 million in 2020. However, challenges facing governments in the GCC include:

The shortage of teachers in the region is the second highest in the world due to an overall dearth of teachers globally coupled with a low pool of nationals inclined towards pursuing teaching as a profession in the GCC. The opening of new institutions in the region is likely to worsen the situation.

In the current global investment climate, private education providers find it challenging to receive sufficient funding for projects. Although banks actively provide loans to players in the education sector, they are limited to entities with a credible track record.

As several new schools are opening and under development in the region, competition among the private players is increasing. This is also leading to an oversupply in the education market, especially in Dubai, thereby intensifying competition and impacting profitability of newer players.

A government-imposed restriction or limitation on the fee hike is another challenge faced by the private players. With no or little increase in fees, which is not proportional to the rise in costs, private schools are unable to spend on upgrading their infrastructure and resources.

Rather than enrolling at institutes within the region, students in the GCC prefer to pursue education abroad, either through self-funding or with external support. Another factor driving the outflow of students is the rising cost of education in the GCC.

The GCC education system is yet to align itself with the needs of the globalised industry. As a result of the skill gap, the member nations face a high rate of unemployment among the youth.