Global sales of major domestic appliances are forecasted to reach $188 billion (Dh691 billion) this year, according to the conveniently named statistics portal Statista.com. The main players behind this growth are the Haier Electronics Group, Bosch, Electrolux, LG Electronics, General Electric and Whirlpool.

Research and Markets’ report on the global household appliance market predicts it to expand to $343.98 billion in the next four years at a compound annual growth rate (CAGR) of 6.1 per cent.

Smart China

The report points out that the Middle East, India and China are going to be pivotal for the industry.

RadiantInsights.com attributes the performance of the Chinese home appliance industry to a reduction in the prices of raw materials and effective corporate transformations. This market’s operating revenues are estimated to have been between $22.3 billion and $22.5 billion in 2015, representing 2-3 per cent year-on-year growth.

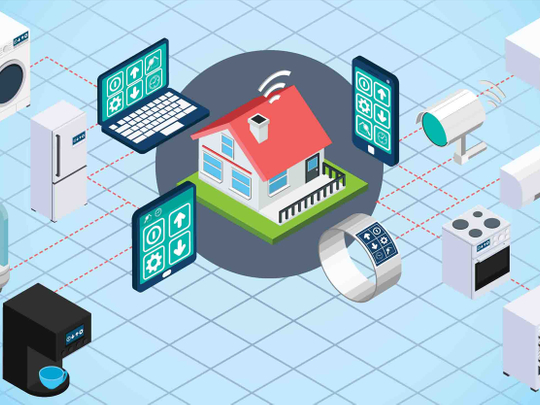

Brands are dabbling in innovation to carry the industry into the future. Global research and data giant IHS predicts the smart appliance segment to enjoy robust growth leading up to 2020. How? Well, over the past decade, consumers have adopted, understood and embraced new technologies, smartphones, touch controls and apps.

Furthermore, smart appliances are expected to be more energy-efficient, and regulations encouraged by governments and authorities help the category innovate and develop this trend.

Change of mindset and directly engaging with the end consumer will be two of the most important factors that determine success, says Dinesh Kithany, Senior Analyst, Home Appliances, IHS Technology.

The IHS report says, “Some consumer electronics companies like Samsung and LG, which have shifted focus from other mature businesses like mobile and TV to smart technology devices, could gain first-mover advantage. They could benefit from the convergence of mobiles and TVs with their home appliance business, as all of these integrate well with smart technology.”

Get connected

One of the main products that will see impressive growth is the smart washing machine. Market research portal ReportsnReports.com predicts the connected and smart washing machines segment to grow at 7.68 per cent CAGR to 2020 thanks to the increased use of internet of things and wireless connecting devices.

The report adds that manufacturers are catering to the growing demand for convenient products while marketers focus on rapidly advancing technologies to develop smart appliances.

Samsung, for example, launched its Add Wash front-load washing machine this year. It provides an option to add laundry midway through a wash cycle via an access door. LG’s TWINWash, on the other hand, lets consumers wash two loads at once.

As the global demand for appliances increases significantly, analysts predict the home comfort and premium category segments are paramount. Last month, LG announced a first-quarter operating profit of $420.25 million.

The Korean tech giant saw a 65.5 per cent increase in sales over the same period in 2015. Its home appliance division raked in $3.51 billion, an increase of 4 per cent year-on-year largely due to higher premium product sales, such as its Signature Series of appliances, and growth in B2B operations.

Moreover, operating profit and operating margin of 9.7 per cent were the highest in the history of LG home appliances.

Samsung’s latest results show its consumer electronics division — encompassing the visual display, digital appliances, printing solutions and health and medical equipment businesses — posted 10.62 trillion won (about Dh33 billion) in consolidated revenue and 510 billion won in operating profit for the first quarter.

The company said its appliance business saw improved quarter-on-quarter earnings, led by growth in North America and increased sales of — you guessed it — premium products such as the Chef Collection refrigerators and the Activewash washing machine.

Closer to home

When it comes to technology, premium is usually synonymous with our region. Euromonitor International attributes the notable performance of the home appliance segment in the UAE to a number of trends, including the shift from renting to home ownership. Its February report also highlights growth in semi-furnished property sales and the expat population as factors.

Consumer appliance sales in the country last year stood at 2.94 million units. Euromonitor predicts sales to reach 3.2 million units by end of 2016, and four million by 2019.

While premium appliances seem to be trending globally, health-conscious appliances are popular locally. Analysts link the focus on health and wellness to high levels of obesity, diabetes, allergies and respiratory problems.

Food preparation products such as smoothie and soup makers, electric grills and steamers and other small cooking appliances are seeing strong growth thanks to the fitness-obsessed.

Cautious residents are also opting for air purifiers and steam vacuum cleaners due to health and allergy concerns linked to dust and air pollution.

Ramadan always proves favourable for appliance sales in the region. When asked on its strategy for this time of the year, Taehun Ryu, Vice-President, Head of Appliance MEA Sales and Marketing, LG Electronics, says, “The holy month is an important time for us. I have spent 15 years in the Middle East and Africa and this will be my 15th Ramadan. This month, we’re looking at gifts with purchases and special discounts.

“We expect to see a 30 per cent sales increase this year, compared to the same period in 2015.”

As global and regional sales of home appliances continue to grow, innovation and premium products will serve as a solid foundation for this expansion. Proving that if something is expensive enough, and more importantly, can connect to smartphones, we’ll buy it.