Product innovation more usually associated with prestige skincare is adding value if not extra volume to the GCC’s highly competitive haircare sector, with growth fuelled by demand for high-performance, multi-tasking brands with enhanced functional and emotional benefits.

Sales of hair products in the GCC’s top performing markets hit $746.5 million (Dh2.74 billion) in 2016 up from $736.2 million in 2015 in Saudi Arabia; in the UAE they reached $303.5 million compared to $290 million for the same period, according to Euromonitor International (EMI). The market analyst says two major trends influence consumers, developments in skincare, and natural ingredients. These trends are manifest in the extension and segmentation of haircare routines and in greater labelling scrutiny.

Ultra-high UV protection, colour correction, intense repair moisturisation and anti-ageing are just some benefits influencing hair care; the other is a budding preference for organic options that are seen as gentler but capable of superior enhancement.

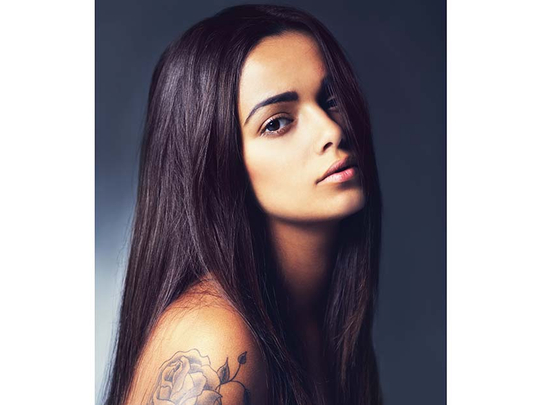

Not to put too fine a gloss on it, consumers in the climatically brutal GCC expect all this and more from their hair products. “Hair and beauty go hand in hand and both need to be cared for very differently in hot and humid climates than in cooler places,” says Shirley Conlon, founder of Dubai-based Shirley Conlon Organics.

The mane event

Unsurprisingly the arid and largely affluent GCC is awash with haircare brands. A hair’s breadth lies between the region’s leaders, Unilever and P&G. In the UAE, Unilever Gulf holds a 23 per cent value share, Procter & Gamble Gulf has 22 per cent, says EMI.

Leading cross-category innovation from skincare are the multinationals, armed as they are with hefty R&D budgets and strong brand credentials.

Flying high in Unilever’s portfolio is 60-year-old Dove which landed in haircare in the 1980s and has since spawned several beauty-inspired lines, including Dove Advanced Hair Care. “The range offers superior solutions that supplement the natural deficiencies in hair,” says Abhiroop Chuckarbutty, Personal Care Director, Unilever Gulf.

Other high-profile skin-to-hair brands include Nivea, with a 105-year pedigree in skin and sun care, and Beiersdorf’s DermoCapillaire range, which debuted in 2012 but learned much from its 130-year-old Eucerin pharmaceutical skincare.

However it’s the debut of micellar shampoos that conclusively confirms skincare’s enduring influence over new haircare products. Very much the cleanser du jour, micellar waters use micelle oil particles to remove dirt without stripping moisture.

L’Oreal salon brands are leading the way with Redken’s Clean Maniac Clean-Touch Micellar Shampoo and Kérastase’s Aura Botanica Bain Miscellaire. P&G recently added Pantene Pro-V Micellar Purify & Nourish to the range.

Naturally shiny

Turning to organics and, again, skincare blazes a trail with ‘free-from’ and ‘natural’ claims. “Interest is growing in the development of organic and natural formulations, as consumers begin to view their hair as an extension of their skin,” Hannah Symons, beauty and personal care analyst tells GN Focus.

“Nowadays anything targeted for skincare is easily replicated within hair, such as anti-ageing and anti-pollution. This indicates a marked move away from remedial solutions and towards preventative care, although the space is still relatively niche, compared with skincare.”

Ecovia cites the UAE as the GCC’s largest market for organic personal care products but, as EMI states, Saudi Arabia is also showing a nascent but strong interest in organic haircare, especially among women.

Natural oils such as coconut have become popular in the kingdom along with products that have natural or organic ingredients. Consumers will continue to focus on and upgrade to high-quality products, which will lead to global products being launched locally, adds EMI.