Nearly half (48 per cent) of UAE respondents have a very positive outlook on the future of the UAE economy, while 60 per cent believe slow business conditions are temporary and will only last about a year.

The findings were thrown by the Consumer Confidence Index survey, conducted by Bayt.com, the regional job site, and YouGov, a market research agency. Nearly 4,000 people were interviewed across 13 countries.

UAE residents report high confidence, with a third planning to buy a new car and one-fourth confirming intent to purchase a new home - both within the next year. However, the survey threw up worries about rising costs, with nearly 60 per cent of respondents expecting their lives to get more expensive.

Elissavet Vraka, Research Manager, YouGov, said: “Gauging consumer opinion is a powerful tool for revealing the current attitudes and sentiments about the business and economic conditions in a specific country. Despite the positive outlook on the future, the rising cost of living is negatively impacting residents’ ability to save.”

Country’s economic situation

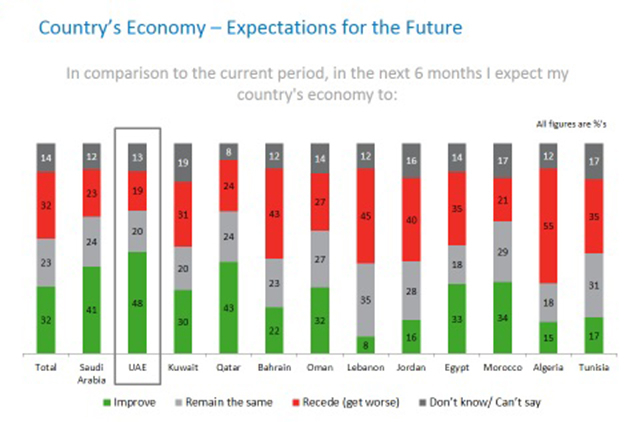

Just over a quarter of UAE respondents believe that the country’s economy has improved in the last six months (26 per cent), while almost a third (32 per cent) believe that it has receded. However, close to half of the respondents (48 per cent) expect the economy to improve in the next six months, vastly outnumbering the smaller group of only one in five who expect it to get worse.

In the UAE, 31 per cent of employed respondents believe that business conditions are either ‘good’ or ‘very good’; however, 30 per cent believe that business conditions are ‘bad’. However, respondents are largely optimistic about the future, with 60 per cent of them expecting business conditions to ‘get better’ in a year’s time.

Personal economic situation

According to 40 per cent of UAE respondents, their personal financial situation is the ‘same as it was six months ago’ (25 per cent say it is ‘better than it was six months ago’, while 27 per cent claim that it is ‘worse’). The outlook for the next few months is positive though: 51 per cent of respondents believe that their personal financial situation will ‘improve’ in the next six months. When it comes to cost of living in the next six months, 58 per cent of respondents expect it to increase, while 23 per cent expect the cost of living to remain the same.

Almost half of UAE respondents say that their savings have ‘decreased’ when compared to last year. On the other hand, 18 per cent (i.e. fewer than one in five respondents) claim that their savings have ‘increased’ this year, while 29 per cent say that their savings have ‘remained the same’.

Consumer spending

36 per cent of those surveyed in the UAE are planning to invest in a motor vehicle in the next 12 months. Of those, 41 per cent are planning to buy a new vehicle, while 38 per cent are planning to buy a used one. 51 per cent of UAE respondents are not planning on purchasing a vehicle this year.

When it comes to investing in property, 26 per cent of UAE respondents are planning to invest in the next 12 months. Of those who are planning to buy property, 49 per cent will invest in an ‘apartment’, while 27 per cent plan to buy a ‘villa/townhouse/bungalow’, and 19 per cent will purchase ‘commercial property’. The majority (55 per cent) of respondents who are planning to invest in property in the UAE in the next 12 months plan to buy ‘new’ property, while 18 per cent will invest in ‘pre-owned’ property.

Regarding consumer goods, 24 per cent of UAE residents plan to purchase a ‘tablet or smartphone’ in the next six months, while 23 per cent will invest in a ‘desktop or laptop’. Around one in five respondents (19 per cent) in the UAE are planning to buy ‘furniture’. An ‘LCD or Plasma TV’ (14 per cent), a washing machine (12 per cent) and cooking range (12 per cent) are also among consumer goods which UAE respondents plan to buy in the next few months.

Current job perspective in the UAE

Presently, 35 per cent of respondents surveyed in the UAE believe that there are plenty of jobs available in the country, with 19 per cent claiming availability across ‘multiple’ industries. 16 per cent claim availability of jobs but only across a ‘limited’ number of industries. 30 per cent of UAE respondents expect the job availability to ‘increase’ in the next six months.

31 per cent of employed UAE respondents feel that the number of employees in their company has ‘increased’ over the past six months, while 35 per cent believe the opposite to be true. Over the course of the next six months, 38 per cent of employed UAE respondents expect the number of employees in their organization to ‘increase’.

With regards to satisfaction levels, 47 per cent of employed UAE respondents are satisfied with their career growth opportunities, and 37 per cent of them are satisfied with their current compensation. On the other hand, 42 per cent are dissatisfied with their current salary and allowances. When it comes to non-monetary benefits, 43 per cent of employed UAE respondents are satisfied, while 37 per cent feel the opposite. 43 per cent of employed UAE respondents feel secure in their jobs.

“While the region as a whole has seen a relative dip in consumer confidence, future expectations amongst respondents remain positive and bright,”said Suhail Masri, VP of Employer Solutions, Bayt.com. “At Bayt.com there are currently more than 10,000 jobs postedon the website on any given day. Jobseeker registration on our website is growing at over 12,000 new professionals a day and continues to reflect a healthy appetite for jobs across the industrial and career spectrum. In an extra-competitive job market though, we advise professionals to enhance their visibility to employers by creating online profiles on Bayt.com and increasing their visibility on popular search engines."

Data for the Bayt.com Middle East and North Africa Consumer Confidence Index survey was collected online from January 27 to February 10, 2016, with 3,905 respondents from the UAE, KSA, Qatar, Oman, Kuwait, Bahrain, Syria, Jordan, Lebanon, Egypt, Morocco, Tunisia and Algeria. Males and females aged 18 years old and above, of all nationalities, were included in the survey.