The dominance of construction continues unabated in the UAE, and dropping oil prices are not expected to steal the industry’s thunder. This is the opinion of industry experts, builders and investors alike, marked by overall positivity as the relative health of the industry shows economic diversification is bearing fruit.

The main drivers for the sector remain UAE-wide infrastructure spending and investments in tourism and commercial or mixed-use property ahead of Expo 2020, as well as continued residential construction activity. Stable material costs and a stronger currency are partly offsetting lower oil revenues.

Analysts’ optimism for the sector over the next few years is also based on a global economic recovery, the UAE’s safe-haven status and its liberal investment climate, improved real-estate regulatory framework, as well as a buoyant infrastructure project pipeline as part of the country’s Vision 2021.

“The entire GCC construction industry foresees growth from 2015-18, encouraged by factors such as favourable macroeconomics, positive demographics and rising tourism activities,” said Sameena Ahmad, Managing Director at Alpen Capital.

“Higher budget allocation towards the construction sector, as part of the strategic vision of the member nations, lends an added push to the industry.”

Constructing value

In June, His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, in his regular review of the UAE’s economy, announced that the construction sector had reached a production value of $81 billion (Dh298 billion) last year, up from $42.2 billion in 2006.

“The UAE has diversified its economy to reduce its dependence on oil, built more balanced management of global economic forces, and established a clear policy of openness and cooperation in order to align with the interests of other global players,” Shaikh Mohammad said.

He pointed out that a large number of infrastructure projects, such as the expansion of national airports at a combined cost of $27.2 billion, and the construction of the Etihad Rail network (around $10.9 billion), in addition to roads and transport projects, new and improved tourist facilities, electronic infrastructure, real estate and financial services are all expected to support growth expectations for 2015.

Business intelligence firm BMI Research, in its latest country risk report on the UAE, upgraded its forecasts for growth in the UAE’s construction sector for 2015 and up to Expo 2020. “We see real growth of 8.3 per cent in 2015 over 2014,” explains Edward Coughlan, Head of Middle East and North Africa Analysis.

“Dubai will be the outperforming market, although we expect growth will remain healthy across the UAE, even with low prices. Government investment will be robust in infrastructure sectors, while the biggest risk stems from private investment in Abu Dhabi, which will be adversely affected by lower oil prices.”

According to consultancy Deloitte, the UAE has construction projects worth more than $720 billion currently under way or planned, including infrastructure.

Among the largest projects is the expansion of the Dubai Metro, which will reach a network spanning more than 110 kilometres by 2020 and 421 kilometres by 2030, with four new lines and 139 new stations. Costs for the country’s biggest infrastructure project are budgeted at $14.35 billion, according to Alpen Capital.

Pricey projects

Other big projects are Emirates Road’s expansion up to 2016 ($12 billion), and the Etihad Railway network with completion set for 2018, followed by the expansion of the Dubai and Abu Dhabi airports and the Abu Dhabi Metro at a project value of $7 billion. Costs of around $10 billion are also scheduled for the three phases of Barakah Nuclear Power Plant west of Abu Dhabi. These mega projects alone will use more than $70 billion in construction and infrastructure investment.

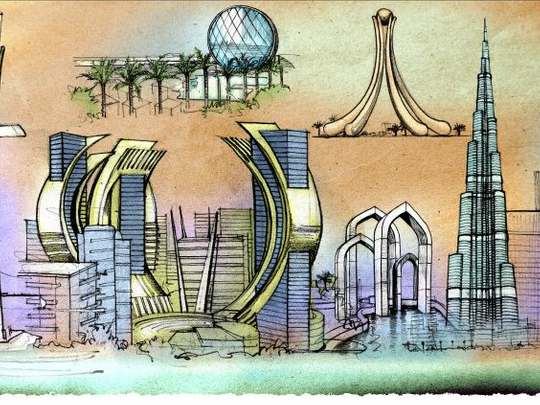

Apart from that, there is also a number of large property developments — some of them partly or fully privately financed — under way in the UAE, including Meydan City, The Lagoons, Mohammad Bin Rashid City, Jumeirah Garden City, Dubai Creek extension and Arabian Canal, Deira Islands, Dubai Waterfront and Bluewaters Island in Dubai, as well as Al Maryah Island, Khalifa City, Al Reem Island, Al Raha Beach, Saadiyat Island with the Cultural District and the ongoing development of Masdar City in Abu Dhabi.

Add to this a number of other developments such as new or extended hotels, hospitals, schools and shopping malls.

The big picture

Altogether, the UAE, along with Saudi Arabia and Qatar, are the current top three markets for the construction sector in the GCC. In Saudi Arabia alone, projects worth around $1.2 trillion are presently under way, which grants the country the top position in the region.

The UAE, with $720 billion, ranks a solid number two and Qatar follows with projects worth around $200 billion ahead of the FIFA World Cup in 2022.