Sometimes things that you assume are associated turn out not to be. One of those pairings is the stock market and the economy.

Although it may be argued they are ultimately related — since eventually stocks should be validated in their valuation by signs of economic growth, translating into corporate earnings — the fact is that economic and stock market trends at least deviate for extended periods.

That dislocation in time is understood by many as the stock market's discounting of what's ahead, by perhaps six to 12 months. In which case, it would seem that causality runs from evidence on the economy to stock prices, although the performance of the former actually follows the latter.

Yet, where markets are of a critical size relative to GDP, they can be not so much a leading indicator of an economy as imparting their own meaningful effect, and becoming predictive.

So we could deduce that the relationship cuts both ways.

‘Wealth effect'

Indeed, Western central banks are currently trying to take advantage of the so-called ‘wealth effect' by boosting financial markets — both bonds and stocks — with freshly printed (albeit electronic) money, hoping that they will kick-start consumption and renewed economic buoyancy.

Hence, a certain circularity is in play.

Tom Stevenson, director at fund manager Fidelity Investments, agrees that causality "does work both ways". But insofar as markets give the impression that they are looking forward, in fact "what they are probably doing is reacting to what is happening now" in the form of lower-order statistics and anecdote. That's not so much ‘forecasting' as ‘nowcasting', he suggests.

As to the authorities' quantitative easing efforts, he concurs that in the US Fed chairman Ben Bernanke has been completely explicit; that monetary impetus is meant to drive up asset prices and thereby spur the real economy.

In the Gulf the linkages between stock markets and the economy are liable to be more complicated still, considering the relative immaturity of the markets and the particular nature of the region's economies and policy templates.

‘Relationship breaking'

An obvious connection, however, suggests itself. "Since GCC economies are driven by oil revenues, periods of high oil prices have fed into the stock market through increased liquidity and petrodollars," M.R. Raghu, head of research at Markaz, confirms. "However, this relationship seems to be breaking, with oil prices no longer driving stock market performance.

"We believe [that] to be a result of lower lending by banks in general and for the purpose of investing in the stock market in particular, [but] we expect this correlation to pick up once credit lines loosen, which may take another year or so."

Thus the banking sector as intermediary is a key factor here.

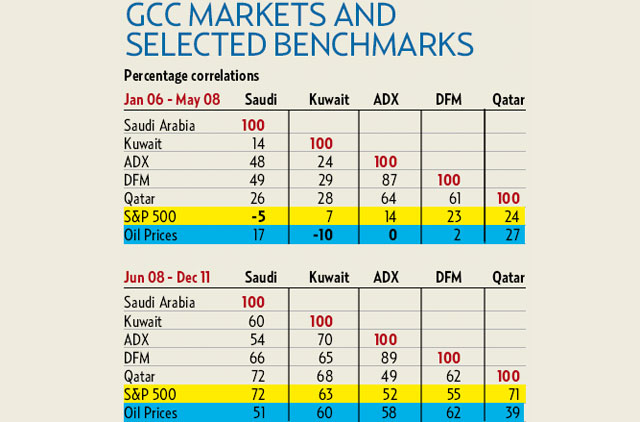

Meanwhile, the influence of overseas markets upon Gulf market indices has turned, owing to the extraordinary events in recent years. Majdi Gharzeddeene, head of investment research at Kamco, relates that whereas correlation used to be "minimal", that has changed since 2008 "due to the financial crisis, and capital mobility". Investors are now "cautiously monitoring" broader horizons, he says. While denying any strong link with either oil prices or the economy, Paul Gamble, head of research at Jadwa Investment, underscores the positive correlation which has emerged between GCC and world markets.

"Prior to the financial crisis some local markets were negatively correlated [as investors would repatriate funds during problematic periods for global markets and vice versa], and many initially thought that regional markets would be insulated.

"This was definitely not the case," he declares, [and] as integration with the international economy and financial flows is enhanced "it is likely that a closer relationship will be maintained", so Gulf investors are best advised to "pay attention to the rest of the world".

Global surveys: studying relationships

The relationships between stock markets and economic variables (besides with each other) has been investigated repeatedly by research studies.

On a global basis, surveys across international bourses appear to support the view of market trends predating the economy, pointing to the precedence of asset market demise in the Great Depression of the 1930s and the so-called Lost Decade of Japan in the 1990s as examples.

As to the GCC, the academic literature shows variously that:

(a) Gulf markets are no longer decoupled, with evident spillover effects from both global and other regional influences;

(b) Oil prices have ambiguous impacts, as the positive effects of liquidity surges are offset by the negative effects on other economies reverberating back to the Gulf;

(c) The region's markets to some extent diverge, despite economic similarities, allowing some measure of portfolio diversification between them.

A paper by Zawya.com last November found that the GCC's markets do not move in parallel with economic fundamentals but are governed as much by sentiment and other factors. The outcome implied that investing requires a "creative approach", being more an art than a science.