Dubai: They were never close friends, and after the inauguration of US President Donald Trump, both Washington and Beijing exchanged statements that showed how they became frenemies on two fronts; political and economic.

Politically, Trump warned China that Washington is ready to defend its interests in the South China Sea. China responded by warning the US to “speak and act cautiously”.

On the economic level, Trump pledged during his election campaign of taking protectionist measures against China, such as imposing tariffs against Chinese products — and he is expected to take some actions in this direction —, Beijing seems ready to retaliate for any measure by Washington, economic experts said.

US-China relations are probably heading for a “chilly period,” said David Dollar, economic expert at Washington-based Brookings Institute, told Gulf News.

“The US and China are each too big to push the other one around,” he added, hoping that the US will “only pursue small measures and this trade war will be more rhetorical than real. If the US introduces major protection this will be bad for the US and the world economy.”

The American-Chinese tension constitutes at present, the greatest source of geopolitical risk in the world, explained economic experts.

“Both countries risk falling into the so-called ‘Thucydides Trap’ that history sets for every incumbent power and the rising power that challenges it,” said Dubai-based Jawad Mian, Founder of the Global Macro Research Firm, Stray Reflections.

“Basically, US fears China’s growing capability and ambition,” he explained to Gulf News.

Reality and facts on the ground clearly show it, economists said.

Since its accession to the WTO in 2001, China has sold about $4 trillion more in goods and services to the US than US has sold back to them. China accounts for 48% of the US trade deficit, amounting to $350 billion.

“A trade imbalance of that magnitude is unsustainable,” said Mian, pointing out that this was one of the several things Trump has promised his voters to do something about it.

“China’s entry into the international economic order was predicated on the assumption that once China becomes wealthy, it would reform its economy to match G7 standards and share its middle class with the rest of the world.”

Today, 45% of China’s population is middle-class, which makes China potentially the world’s second-largest trading bloc after the EU, explained economic experts.

This is the reason why Trump’s administration wants China to open up further to US exports (manufacturing, tech, and services), and provide unopposed access to its vast consumer market.

Europe, which has a population of 743 million, is the world’s largest exporter of manufactured goods and services, and is itself the biggest export market for around 80 countries, according to official European sources. (European Commission).

With 1.3 billion population, China is the second largest economy in the world after the US, concluded the International Monetary Fund (IMF)’s World Economic Outlook Database of October 2016.

The $18.5 trillion US economy is approximately 24.5% of the gross world product. However, the US economy loses its spot as the number one economy to China when measured in terms of GDP based on PPP. In these terms, China’s GDP is $21.3 trillion and the US GDP is $18.5 trillion. However, the US is way ahead of China in terms of GDP per capita (PPP) — approximately $57,294 in the US versus $15,423 in China. The US population is estimated around 318 million.

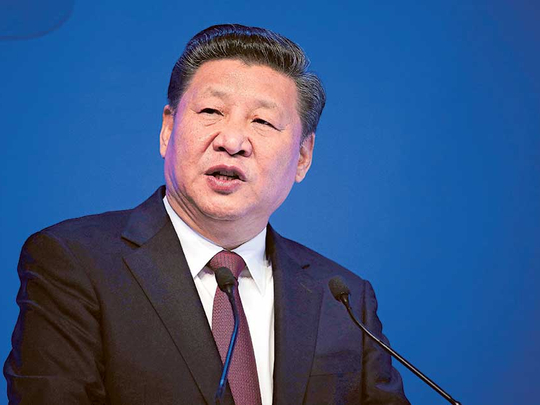

While US President Trump is talking about ‘making America great again”, Chinese President Xi Jinping spoke of “China Dream”, economists said.

At present China is looking into “diversifying” its trade exposure away from the US, thought boosting its trade relations with Europe and Asia, through “The one Belt, One Road initiative,” they added.

“China has been trying to diversify trade away from the US, or at least reduce its dependence on the US as a market,” said Thomas Streater, Dubai-based Head of Research at MB Commodities Capital, propreitary trading business. “Because the US recession of 2008 really hurt China’s economy and I think China learnt some lessons from that.”

On the other hand, President Trump has “limited” options in fulfilling his promises of being “tougher” with China because of the fact that “China is an extremely important lender to the US treasury.”

“It must be noted that Rex Tillerson, his choice of Secretary of State, is pro free trade, which means it is not entirely obvious the US will try to reduce trade on a large scale on purpose with its most important trading partners,” Streater said.

Tillerson is coming to the state department with a solid business background. He is the former chairman and Chief Executive Officer (CEO) of ExxonMobil.

The US, which heavily relies on China to finance its deficits, might impose some measures on its trade with china and could ‘intimidate’ china by increasing its military presence in the Asian Pacific region.

China, on the other hand, can retaliate and ‘punish’ the US by reducing its purchases and holdings of US Treasury securities. By doing so, it will make the efforts of Trump administration to finance his infrastructure plans more difficult, economists said.

“Both countries could impose new tariffs on each other,” said Streater. “If the US and China really entered into a trade war, it would be a lose-lose scenario and we’d likely see another global recession.”

Other economists share similar view.

Dollar said high US tariffs would make Chinese imports more expensive and reduce its volume in the American market. But china could “retaliate” and shift the sources of its imports for aircraft, advances equipment and agricultural products away from US first.

Any trade war between US and China makes both sides worse off, Dollar said.