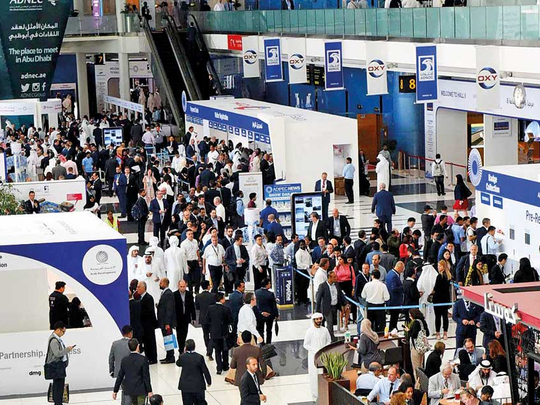

Abu Dhabi: The Abu Dhabi International Petroleum Exhibition and Conference (Adipec) opened its doors on Monday morning, amid a slightly recovering oil prices, providing attendees with some cause for optimism.

The four-day event was opened by Shaikh Hazza Bin Zayed Al Nahyan, Deputy Chairman of Abu Dhabi Executive Council, who toured the exhibition, inspecting models and meeting with business owners.

Opening with a keynote presentation from Sultan Al Jaber, the group chief executive officer of Abu Dhabi National Oil Company (Adnoc), the ceremony continued with speeches from Suhail Al Mazroui, UAE Minister of Energy, and Mohammad Barkindo, secretary-general of Opec.

ALSO READ:

• Adipec opens as oil posts some gains, before slipping slightly

• Gulf oil ministers confident about Opec deal extension

• How to survive downturns in the oil industry

• Mubadala seeks energy stakes after spending $5b

Al Jaber confirmed in his opening remarks to the audience that the state oil giant would indeed be listing a 10 per cent share of its fuel retail business on the capital’s bourse.

In attendance at the 20th edition of Adipec were oil and gas executives from around the world, including the heads of Total, BP, Pemex, and others, in addition to energy ministers from the Gulf countries, and the Opec secretary general.

High on the agenda at the conference was the extension of the oil output agreement beyond March, an issue touched on by the UAE’s energy minister in his welcoming remarks.

- Spencer Welch | Director of IHS Energy

Al Mazroui described how the deal between Opec and non-Opec countries had helped remove some of the oil glut.

He added that he was optimistic 2018 would see even greater recovery than this year, with more investment in the industry.

Barkindo, the head of the oil industry group, echoed Al Mazroui’s comments, saying that the oil market was rebalancing at an accelerating pace off of the back of the deal to cut production.

Opec (Organisation of the Petroleum Exporting Countries), along with other non-Opec oil producers, is cutting production by 1.8 million barrels per day in order to prop up prices, which crashed unexpectedly three years ago. The agreement, which was to expire in June, was extended till March next year.

The event takes places as oil prices rise due to geopolitical tensions throughout the Middle East, and a tightening of global oil markets following the production cut agreement.

Oil surged above $63 (Dh231) a barrel to its highest level in two years last week after Saudi Arabia’s crackdown on princes and businessmen raised concerns over stability and policymaking in the world’s largest oil producer.

Brent rose to $64.65, its highest since June 2015, and WTI rose to $57.92 a barrel, its highest since July 2015 earlier last week. Brent has since dropped to $63.52, whilst WTI has dipped again to $56.80, as of Monday.

Oil was moving upwards even before Saudi Crown Prince Mohammad Bin Salman launched his purge which included the detention of billionaire investor Prince Al Waleed Bin Talal, the head of Kingdom Holding.

“Although political developments in Saudi are fascinating they are unlikely to have much impact on oil price because a significant change in Saudi oil policy is unlikely. More significant would be any developments in Kurdistan to re-establish the lost production or exports or anything further said in the US about re-instating sanctions on Iran,” said Spencer Welch, Director of IHS Energy in London.

Oil has gained more than 20 per cent since the beginning of September on signs global supplies are tightening and news that Opec and its allies may extend the output deal beyond March. Fighting between Iraqi government and Kurdish forces over the disputed oil rich region of Kirkuk also boosted prices.

To be held under the theme “Forging Ties, Driving Growth”, this year’s Adipec is expected to host more than 10,000 delegates, 2,200 exhibiting companies, 900 speakers, and in excess 100,000 visitors from 135 countries.