Dubai: Abu Dhabi National Oil Company’s (Adnoc) deal awarding CEFC China Energy Company a stake in Abu Dhabi’s onshore oil concession is strategic for both parties, especially as China emerges globally as a key growth market, analysts said.

On Monday, Adnoc announced it has signed an agreement to give CEFC a 4 per cent stake in the concession, after the Chinese firm contributed a sign up bonus of Dh3.3 billion to enter the concession.

Richard Mallinson, geopolitical analyst at research consultancy Energy Aspects in London, said the announcement was not a great surprise as it had been known that Adnoc was interested in securing investments from key growth markets such as Asia, and specifically China.

“I think that [deal] does reflect the way that [Adnoc] sees the future market for exports; Asia is already the largest net region for crude oil, meaning imports from other regions including the Middle East need to head there and it’s also going to be the main source of demand growth over the next 5-10 years. So, securing partnerships and deepening ties with deals like this is about positioning,” Mallinson told Gulf News.

The deal follows an announcement from Adnoc just a day earlier that it will award an 8 per cent stake in that concession to another Chinese firm, China National Petroleum Corporation.

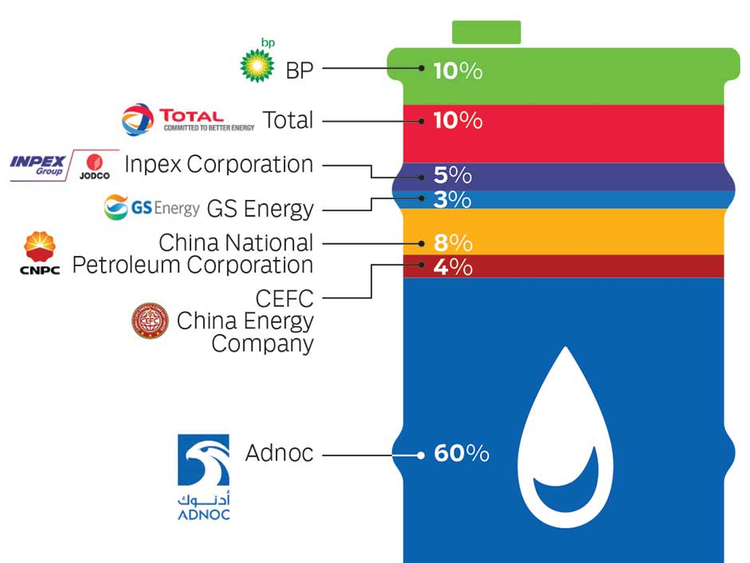

The two deals make China the largest minority shareholder in the concession with a collective 12 per cent stake. France’s Total and the UK’s BP each owns a 10 per cent stake, while Japan’s Inpex Corporation has a 5 per cent stake and South Korean GS Energy has a 3 per cent stake.

The two deals also come as the UAE and China work on boosting trade ties and strengthening bilateral cooperation. They are also come in line with China’s new Silk Road policy, which aims to re-establish old trade routes and ensure security of long-term resource supply.

“We already know China is a huge importer of oil … and that growth is going to continue into this year, so China will keep needing to import more oil. Its demand is growing, but also its own production of oil is falling, so that creates a larger gap,” Mallinson said.

He added, “An existing asset like the UAE’s [concession] is attractive because it has a very low production cost, there’s very high rate of confidence about the rate of production and future outlook, so you don’t have the kind of risk in investing in a project that’s in a much earlier stage and you don’t have the high production cost that apply to a lot of the non-Opec (Organisation of Petroleum Exporting Countries) players.”