Dubai: The UAE’s banking sector is headed into another challenging year following strong economic headwinds the sector faced in 2016, according to banking sector analysts.

Banks are expected to face further slowdown in loan growth, while asset quality issues are expected to persist in 2017. “We expect to see further weakening of loan growth while further increase in non-performing asset (NPL) formation is expected from some sectors such as construction and contracting, real estate, small and medium enterprises and retail portfolios,” said Suha Urgan, banking sector analyst at Standard & Poor’s.

While a significant share of NPL formation from the SME sector that began from the second quarter of 2015 have been largely recognised by the banks in 2016, some impact is likely to linger for next 4 to 6 quarters. As the payment lag in construction and contracting sectors are expected to result in new NPLs from the SMEs, job losses associated with SME and corporates are expected result in further spike in NPLs.

The rating agency expects that contractors, subcontractors, small and mid-size enterprises (SMEs), and highly leveraged retail clients will drive the deterioration of asset quality, as the drop in economic growth prospects has a negative bearing on project pipelines, government subsidies, salaries, and job markets.

The greater exposure of some banks to the real estate sector is also a factor to watch in the current asset quality cycle.

Slowing loan growth and deterioration in asset quality is expected to reflect on profitability of GCC banks in 2017. “Banks with exposure to contractors, subcontractors, SMEs, and some segments of the retail sector will drive the trend. We therefore expect revenue growth to decelerate and banks to focus on improving their cost bases (by closing branches and reducing staff) to mitigate the impact,” said Urgan.

Private sector credit growth in the UAE strengthened in December, led by the corporate sector with a 1.2 per cent month on month growth as retail loan growth remained flat according to latest data from the Central Bank of the UAE.

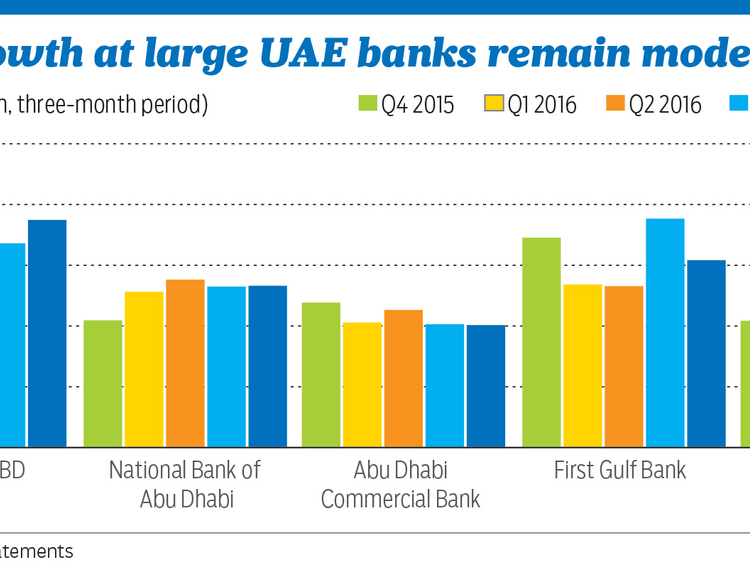

The overall dynamics of the private loan sector in 2016 reflected a softening in economic activity and credit demand, with loan growth decelerating to 5.6 per cent year on year in December 2016 compared to 8.5 per cent in December. The softening in personal credit growth was more pronounced, slowing to 5.3 per cent in December from 10.3 per cent in December 2015.

Uncertainties around job cuts and wage growth were likely factors behind this trend. Analysts expect system-wide credit growth is expected to remain sluggish around 6 per cent in 2017.

“While overall cost of funding is expected to increase due to lower liquidity rising interest rates UAE banks have witnessed a rebound in deposits in the second half of last year, largely driven by a rebound in from government and government related entities,” said Urgan.

According to the latest central bank data December saw robust deposit growth of 2.7 per cent month on month, building on the momentum of 1.2 per cent improvement in seen in November. The UAE’s gross loan-to-deposit (L-to-D) ratio moderated to 100.7 per cent in December from 103.6 per cent in November on the back of the strong monthly deposit growth, pointing to an easing in banking sector liquidity conditions.

“Amid sluggish loan growth, elevated cost of funds and lingering NPL issues, profitability of UAE banks are expected to come under pressure. However we expect private sector credit growth could see some uptick with increased investment activity in 2017 led by Dubai, however government demand for credit could fall with the higher expected oil revenue,” said Urgan.