Dubai: The Gulf Cooperation Council (GCC) governments have been working hard to address the rising fiscal gap following the sustained decline in oil prices, but the problems persist and further reduction in deficits and revenue diversification are required to sustain economic growth and job creation, according to economists and multilateral agencies.

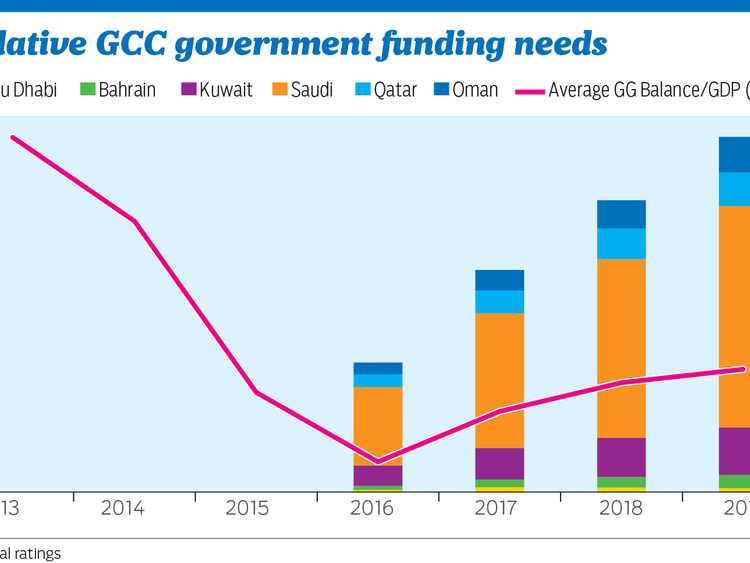

GCC fiscal deficits are forecast to narrow in 2017 to an aggregate of 6.5 per cent of GDP in 2017 on higher oil revenues. The narrower deficits and ongoing foreign borrowings are expected to result in banking sector liquidity easing in 2017. But as a result of the fiscal tightening, support to growth is expected to moderate, potentially impacting GDP and employment growth.

Speaking at the recent Arab Fiscal Forum, Christine Lagarde, Managing Director of the International Monetary Fund (IMF) called on regional governments to deepen and broaden government revenues while rationalising spending.

“GCC countries are working to introduce a harmonised VAT in 2018 along with reduction in various subsidies. The IMF expects VAT could raise anywhere from 1 to 2 per cent of GDP, assuming a rate of 5 per cent. Our experiences in other regions underscore the positive impact of [revenue] diversification,” said Lagarde.

Despite some recent efforts towards revenue augmentation, economists say the region needs a medium term plan to keep deficits at sustainable levels although spending cuts will reduce fiscal support to growth.

Total GCC government expenditure is expected to rise by a moderate 0.4 per cent in 2017 versus a 4.5 per cent drop in 2016. Some GCC countries are seeing a moderate increase in planned spending in their 2017 budgets, while others are seeing a smaller contraction.

“We expect further subsidy reforms to be announced in the second half of 2017, including in Saudi Arabia. Further reforms and spending retrenchment are needed in the medium term to lower fiscal deficits in Bahrain, Oman and Saudi Arabia. We see Abu Dhabi and Qatar continuing to focus on fiscal prudence despite the contained deficits forecast for 2017,” said Monica Malik, chief economist of Abu Dhabi Commercial Bank (ADCB).

Clearly, austerity measures are resulting in lower growth. Oil prices are more comfortable entering 2017, supported by the production cut agreed by Opec and non-OPEC countries.

“Higher oil price should lead to an easing of austerity programmes in 2017, reducing the fiscal drag. This comes after the substantial deepening in fiscal retrenchment and reforms in 2016 — aimed at limiting the widening in government deficits — that resulted in a marked slowdown in real non-oil GDP growth,” said Malik.

While governments are concerned about keeping deficits at sustainable levels, policymakers and economists worry about consequences of higher levels of austerity on economic growth, employment and consumption.

“The wider Arab region needs GDP growth in the range of 5 to 6 per cent to address poverty and unemployment effectively. Last five years the region had an average growth of 3.3 per cent while this year the growth is estimated at around 3 per cent which is short of achieving our targets,” said Dr Abdul Rahman A. Al Hamidy, Director General and Chairman of the Board of Executive Directors of the Arab Monetary Fund.

While the region faces an average fiscal deficit of 10 per cent, Al Hamidy said governments should work towards fiscal stability and improved growth through revenue augmentation and diversification.

The gradual improvement in the outlook is reflected in a moderate strengthening in real non-oil GDP growth in 2017, according to Malik.

“Our top economic picks remain the UAE and Qatar, where we see the greatest momentum in investment programmes and the lowest fiscal deficits in the region. In the UAE, we believe that Dubai will lead the increase in investment expenditure and acceleration in economic activity, with the pace expected to increase as we approach Expo 2020,” she said.

Overall, economists expect GCC real headline GDP growth softening in 2017, with a contraction in the oil sector due to oil production cuts. This is a reversal of the trend seen in 2016, when strong oil output supported headline GDP growth as real non-oil GDP growth decelerated.

“We estimate the GCC’s weighted average real non-oil GDP growth at about 2.5 per cent in 2017, up moderately from 1.6 per cent in 2016. We believe that the gradual pickup in real non-oil activity will be driven by a moderate rise in government-led investments; and private consumption to a lesser degree,” said Shailesh Jha, an economist at ADCB.