Remember Quantum Leap? The sci-fi show where time travelling scientist Sam Beckett would wake up in another era and have to work out where he was in history before solving this week’s mystery. Well, that’s the position the world’s economists and traders are in this week.

Since the end of the last recession interest rates have been historically low. Now with wages rising and the global economy booming central banks look set to end the era of cheap money. As stock markets panic about the short term impact on share prices, Richard Sylla, the co-author of the seminal A History of Interest Rates, and the authority on the subject poses a longer-term question: where are we? The 1950s or the 1970s?

“We are certainly at a turning point,” says Sylla, professor emeritus of economics at the history of financial institutions and markets at the Stern School of Business in New York. According to Sylla’s studies, interest rates have trended in 20 to 30 year cycles and we are overdue a sustained period of interest rate increases.

“Interest rates have been abnormally low and for the first time in a long time every economy in the world is expanding. So everything tells me the trend is going to be up. The question is, what sort of trend will it be?”

Sylla offers two relevant historical models — the 1950s and the 1970s — periods with starkly different economic outcomes.

1950s

In the early 50s, US central bankers began to gently raise interest rates after a period of sustained low rates that ran from the Great Depression through the second world war.

“From the early 50s to the early 60s, there was a gradual upward trend in interest rates that did not interfere with economic growth,” Sylla explains. “Some of the fastest economic growth took place in the 50s, so the idea that rising interest rates have a negative affect on the economy is probably wrong.”

Stable house prices

The 1950s ushered in the golden age of capitalism. If we are as lucky this time and follow a similar course Sylla says, we are likely to see less speculation in stocks as well as moderate increases or stable house prices.

“As interest rates begin to normalise, stocks and real estate are certainly not going to be going up at the rates they have been. That’s the rosy scenario — if we move from abnormally low interest rates to more normal interest rate over a period of time, even over 10 years ahead, it doesn’t have to cause inflation or slow the economy. That’s what we should hope for now.”

1970s

The alternative is the early 1970s. Under that scenario, central bankers raised the target fed funds rate higher 21 times over the course of 1973 as it attempted to tame inflation, stalling the US economy until it slid into stagflation — where prices rise faster than growth.

Everything tells me the trend is going to be up. The question is, what sort of trend will it be?

While there is no energy crisis on the horizon, Sylla’s ‘70s scenario focuses on the effect of Trump’s $1.5trn tax cut at a time of almost full-employment coupled with new, multibillion government spending allocations. In other words, a sugar rush just when the central bank is looking to gently cool, not aggressively stimulate, the economy.

“I see the signs of fiscal irresponsibility out there mainly in things like bitcoin and crypto-currencies but also in the stock market, which has been propped up by very low interest rates. That could turn this into a 1970s-type scenario when interest rates rose very rapidly,” says Sylla.

“There’s a 50-50 chance inflation will heat up and that will force the Fed to raise rates faster. So it won’t be a normalisation or rates, it will be a more rapid rise because the Fed will start to fight the inflation.” And that, Sylla predicts, could be the cause of the next recession.

Increasing volatility

The unfolding situation is likely contributing to the volatility we’ve seen in the markets over the past week, says Simon Johnson, an MIT professor of global economics and management.

“The markets are trying to grapple with the sudden realisation that the Trump-Republican economic policies amount to a short-term economic stimulus in an economy that appears to have very little slack,” he explains.

“We’ve put an expansionary fiscal policy into a situation where we’re at or close to full employment. But the Fed was already on a course to tightening fiscal policy. It’s the kind of policy mistake that did give us the complications of the 1970s. A textbook would say the Fed needs to tighten by more and faster in order to offset Trump’s fiscal stimulus.”

To Johnson, the scenario could end up looking more like the late 1960s era of Nixon and the Vietnam War when the Fed was gradually tightening interest rates but had missed the top of the cycle, allowing underlying conditions to start the 70s inflation cycle.

“In that sense, perhaps we’ve already fallen behind the curve,” Johnson says. “[Former Fed chair] Alan Greenspan’s thinking was you don’t wait for full capacity [in the economy] because there are long and variable lags for all of this.”

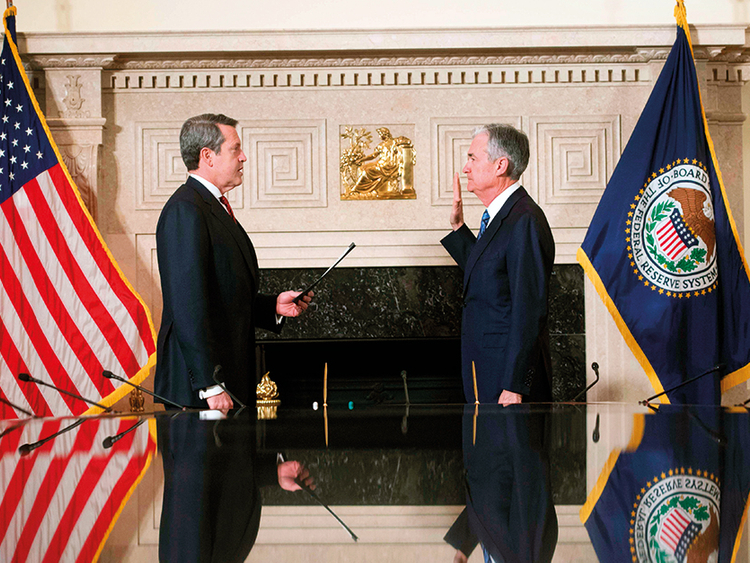

The Fed’s policy goal of normalising interest rates to somewhere close to their historical averages of three to four per cent is not widely opposed by central bankers, not least because that would give the central bankers room to manoeuvre in the event of an economic shock.

But, warns Johnson, Trump may not be the man to learn history’s lessons.

“The last thing Trump wants, as a real estate developer or a politician, is higher interest rates,” he says. “Trump is the ultimate loose-money president. He will likely push hard for low rates at least through the midterms and probably into his re-election.”