Dubai: A new research from HSBC shows that 82 per cent of people in the UAE who do not own their own home, expect to do so in five years.

Despite such high numbers wanting to own property, the study shows many are not adequately planning for this investment.

While lack of funds for the initial deposit is cited as one of the main barriers to buying property, poor budgeting for additional costs — such as broker fees, legal fees, cost of renovation and maintenance fees — are other hindrances to reach their goal.

The HSBC survey assessed the views of over 9,000 people in 9 countries, and over 1,000 respondents in the UAE.

The findings examine the sentiments of four groups of people: total home owners and total non-owners, along with sub-categories of millennial home owners and millennial non-owners.

According to HSBC’s research, 28 per cent of people already own a home, and among those who do not, more than 4 in 5 (82 per cent) intend to buy one within the next five years.

These sentiments are slightly higher than the global average where 73 per cent of non-owners intend to buy property in the same period, but they are in line with the attitudes of millennials in the country. While 26 per cent of people between 18 and 36 are home owners, 80 per cent of non-owners in this segment intend to buy a home within five years.

The study showed that there are significant barriers to achieving the goal of owning the first property in the UAE. While two-thirds of respondents highlighted the need for a higher salary (62 per cent), 42 per cent said they need to save more for a deposit.

Exacerbating these challenges, the research shows that people are not planning carefully, with 82 per cent of total non-owners across the UAE saying that they only have an approximate, or no budget at all when they intend to buy.

As a result, it is not surprising that among total home owners who have purchased property recently, nearly 7 in 10 (67 per cent) spent more than they had initially budgeted. The most common reasons for this — broker fees (64 per cent), legal fees (62 per cent) and renovation costs (57 per cent).

HSBC officials said meticulous planning and budgeting are key elements of achieving the goal of owning a property.

Market conditions

“While we do appreciate that the market conditions today are challenging, there are clearly areas where people can make improvements. By getting a full view of your finances and remaining committed to a budget, you can go a long way towards reducing existing and future pain points,” said Kunal Malani Head of Customer Value Management, MENA, Retail Banking and Wealth Management, HSBC Middle East.

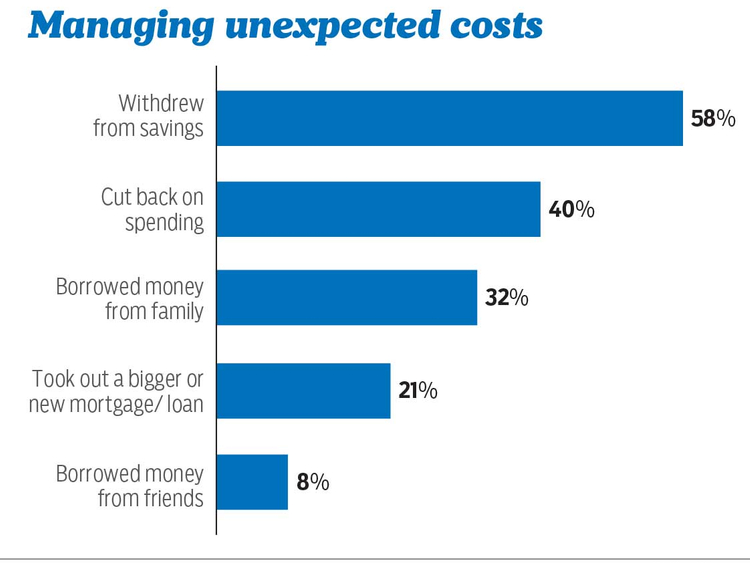

HSBC’s research shows that although total home owners end up managing unexpected costs primarily by withdrawing from savings (59 per cent), there are ways in which this can be addressed more effectively. For example, only 37 per cent would be willing to cut back on spending currently.

Among the millennial non-owners intending to buy, the findings more positively show that they are willing to make sacrifices with 45 per cent saying that they would spend less on discretionary expenses. Today, half of millennial home owners (50 per cent) have used the ‘Bank of Mum & Dad’ as a source of funding, which is the highest globally. This far exceeds around a third of millennial home owners who relied on their parents in the UK (35 per cent) and US (32 per cent).