DUBAI: Dubai’s benchmark index rose on Monday, extending gains for a third session in a row, led by Arabtec and Union Properties. The Abu Dhabi index, meanwhile, fell, even though Waha Capital stock jumped as much as 8.5 per cent.

“We are witnessing positive sentiment [in Dubai] as many investors see this as a good entry point after last week’s fall,” said Sebastien Henin, head of asset management at The National Investor, which handles portfolio worth $100 million.

“I won't be surprised to see profit taking in coming weeks and months as valuations are not that attractive as they were a few months ago,” Henin said.

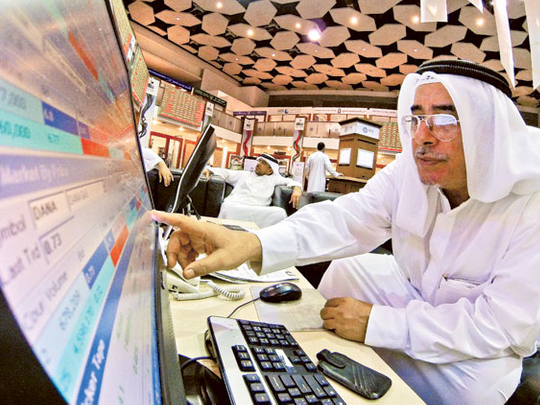

The Dubai Financial Market (DFM) General Index rose 0.54 per cent to end at 5,018.11, after gaining more than 1.61 per cent in the previous two sessions. Arabtec, the most active share by value and volume, rose 3.70 per cent to end at Dh4.77 per share.

“There were some rumours in the market of an agreement of part of the share sale by the ex-CEO at higher than the market price,” Henin said.

Arabtec’s former chief executive, Hasan Ismaik, who resigned abruptly in June, holds about 28 per cent in the company. Ismaik had said earlier that he was in talks with Abu Dhabi state fund Aabar Investments to sell part of his stake.

Emaar Properties, which seeks to raise Dh5.8 billion through share sale in its mall unit, fell 0.44 per cent to end at Dh11.20 per share.

“The Emaar IPO will be drain from the cash point of view and we will see lesser liquidity in coming weeks,” Henin said. The index shed more than 3 per cent last week as investors booked profits to subscribe to shares of Emaar Malls Group’s initial public offering (IPO). The share sale of Emaar Malls Group (EMG), which started on Sunday, ends on September 24 for individual investors and September 26 for institutional investors. The shares will get listed on the Dubai Financial Market on Oct. 2.

Waha Capital jumps:

Shares of Waha Capital, backed by the Abu Dhabi government, rose as much as 8.5 per cent to its highest level since end-July after the company said its board will meet later in the week to approve a share buy-back programme.

The shares rose 6.48 per cent to end at Dh3.12 per share in the Abu Dhabi Securities Exchange, after hitting a high of Dh3.19, a level last seen on July 31. The company‘s board is slated to meet on September 17 at 2pm to discuss and approve of the share buy-back programme,

The company has gained 259 per cent in the past one year compared to 40.63 per cent gains on the Abu Dhabi Securities Market General Index. The index ended 0.05 per cent lower at 5,156.99 on Monday.

Waha Capital reported a record quarterly net profit of Dh1.138 billion for the second quarter of 2014 helped by a one-time gain, up from Dh38.4 million recorded in same period last year.