Dubai: Does a $6 billion retail giant with more than 2,000 brick-and-mortar stores really need an e-commerce arm? The Landmark Group believes it needs one. In recent months, the Group — whose store network is scattered over a wide geography — has been putting its ample marketing muscle behind LandmarkShops.com with the stated goal of developing it into an entity that can stand on its own. The way it plans to do is to build scale into the online operations in much the same way it did on the physical network.

“We integrated the 5.5 million members of the Group’s loyalty programme, Sukhran, into LandmarkShops.com — that certainly helped build up an awareness base much faster than would have been the case,” said Savitar Jagtiani, who heads the e-commerce operations at Landmark. “We have since seen that more than 50 per cent of the sales recorded through the portal were linked to Sukhran accounts.”

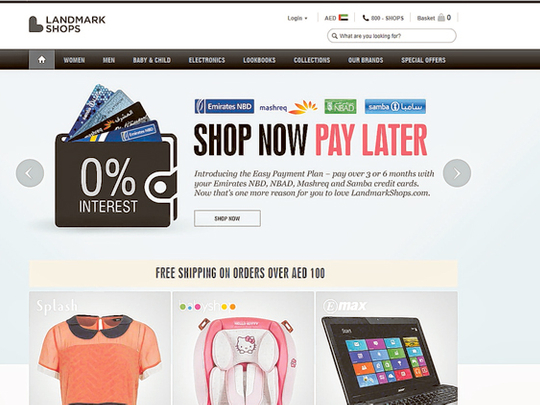

Jagtiani declined to give specifics into the kind of volumes that the portal has been averaging since it went live in December 2012. As of now, the sales and delivery coverage only extends to within the UAE and limited to merchandise from three of the Landmark brands — Splash, Babyshop and eMax. That could be padded up with the addition of home furnishings, which would create an additional ‘vertical’.

On when the coverage could be extended to some of the other Gulf states, Jagtiani declined to go into specific dates, but said that “some time during the year is doable”.

“The initial ‘key performance indicators’ from the e-commerce site suggest we are in the right direction,” said Jagtiani. “Since the start of this year, month-on-month volumes have been up 30 per cent plus.”

The other big retail groups in the UAE or the Gulf have to date not taken up to online channels in a big way. Instead, they have preferred to sell through third-party online vendors or taken up ”virtual” selling space at the Tejuri.com portal. Some of the groups have considered launching their own dedicated portals, but something or the other would always come in to disrupt the plans. (At the same time, standalone e-commerce vendors in the region have been building up volumes and been aided by private equity funds — from within the region and outside - willing to back them up.)

“Given the country’s Agency Laws, retailers or franchise holders can easily sell through neutral portals rather than rack up the substantial cost of developing their own online selling operations,” said a retail industry consultant. “By law, portals selling merchandise in the UAE will have to source from the brands’ official dealers, who are more often than not the big retail groups in the country.”

Where Landmark has an advantage is that it is selling merchandise from its inhouse apparel brands, Splash and Babyshop. Plus there is eMax which is one of the country’s top electronics retailers.

Jagtiani insists that the Group is in for the long term with the online exposure. “The core Landmark Group operations were built over 40 years; nobody expects the online presence to scale up in a short timeframe of just a year and a few months,” he said. “It was clear that it was going to be a marathon and not a sprint.”