Dubai

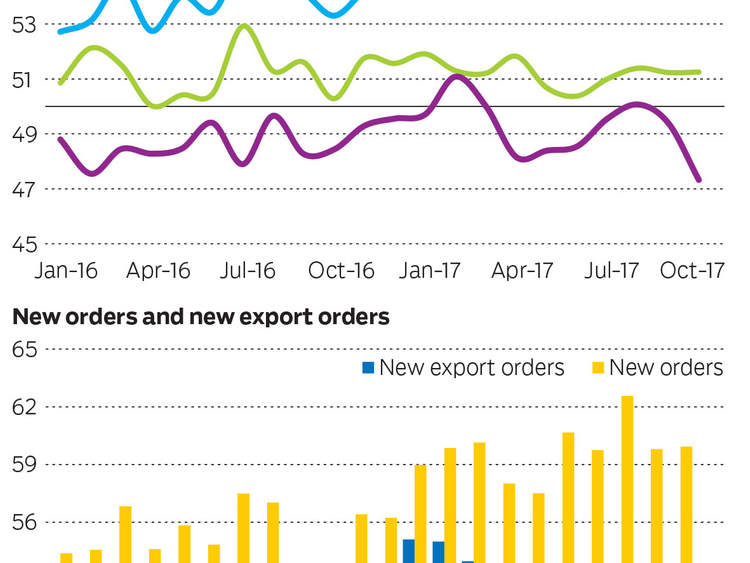

The Emirates NBD Purchasing Managers’ Index (PMI) for the UAE rose to 55.9 in October from 55.1 in September, in a strong start to the fourth quarter. Output and new orders increased at a sharp rate last month, with the output index rising to 60.5 and the new orders index a touch higher than September at 59.9.

October PMI data indicated an uptick in growth of the UAE’s non-oil private sector. “The increase in the UAE’s headline index in October reflects faster output growth and a sharp increase in inventories, as firms anticipate stronger demand in the coming weeks. However, the survey showed that firms continued to discount selling prices in order to support demand, and the employment growth remains modest,” said Khatija Haque, Head of Mena Research at Emirates NBD.

The rate of expansion in output was steep overall and contributed to the latest general improvement in operating conditions.

The strong growth in output and new orders reflect robust demand. However, demand has been supported by continued promotional activities and price discounting by firms. Output (selling) prices declined in October at the fastest rate in more than seven-and-a-half years.

New business received by non-oil private sector companies in the UAE increased sharply last month. The rate of growth was little-changed since September and above the long-run series average.

Input price inflation continued in October, thereby extending the current sequence of rising cost burdens to five months. October’s data suggested that the increase in input prices was primarily fuelled by rising raw material costs.

In spite of increased cost pressures, firms cut their charges for the second month running amid reports of intense competition. The rate of reduction was the fastest since March 2010.

Employment growth continued in the non-oil private sector during October, thereby extending the current sequence of job creation to one-and-a-half years. Emirati respondents commonly linked hiring activity to the increase in output requirements.

Firms cited increased competition as a reason for reducing selling prices on average. Employment increased in October, at a similar rate to September, but the overall rate of job growth remains modest with the index at 51.3 last month. Staff costs were also only marginally higher in October.

Despite the pressure on margins, firms were much more optimistic in October about the coming twelve months, with the business confidence index reaching a five-month high of 61.2. However, this component of the survey is not seasonally adjusted, and businesses are typically optimistic at the start of what is considered the high-season for tourism and hospitality.

Year-to-date, the headline purchasing managers’ index indicates a faster rate of expansion in the UAE’s non-oil economy than over the same period last year.

This [expansion in non-oil economy] is in line with our expectations for non-oil sector growth this year, and likely reflects some increase in government spending (particularly on infrastructure) as well as greater confidence on the back of higher oil prices. However, the improvement in non-oil sector growth will probably be offset by lower crude oil production, in line with Opec-agreed production cuts. We retain our forecast of real GDP growth of 2 per cent in the UAE this year,” said Haque.