Dubai: The non-oil private sector in the UAE reported strong growth in December with output increasing at the fastest rate since 2015 with more than a third of firms surveyed reporting higher output than the previous month.

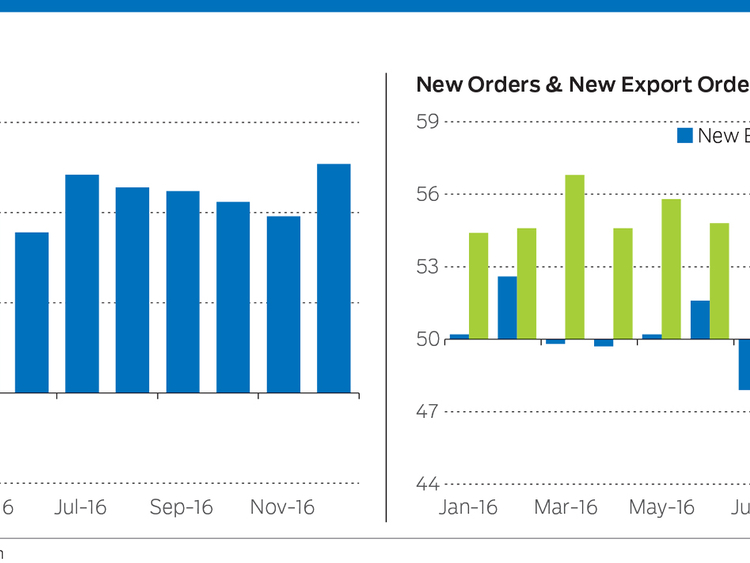

The Emirates NBD Purchasing Managers’ Index (PMI) rose to 55 in December from 54.2 in November, a five-month high. New orders rose at a similar rate to November, and encouragingly, export orders increased for the first time in six months.

“PMI indicates a solid expansion in the non-oil private sector in the fourth quarter of 2016. Strong gains in output and new orders have been hard-won however, with firms continuing to offer discounts and promotions in order to secure orders. Overall, the PMI averaged 53.9 in 2016, well below the 2015 average of 56, reflecting slower growth this year,” said Khatija Haque, Head of Mena Research at Emirates NBD.

One of the key themes that have emerged from the PMI surveys over the last year has been sustained activity/output growth against a backdrop of lower oil prices and tighter fiscal policy. To some extent, activity in the non-oil sector has been supported by increased crude oil production last year, which has fed through to oil-related manufacturing. However, firms have also consistently cut selling prices in order to compete for new work. Output prices fell again marginally in December, the fourteenth straight month of sub-50 readings in this component of the PMI.

“With input prices continuing to rise, firms’ margins remain under pressure. One consequence of this has been firms’ reluctance to take on additional costs and employment growth has been lacklustre this year despite the strong rise in output,” Haque said.

The employment index averaged just 51.2 in 2016 compared with 52.4 in 2015. Backlogs of work was broadly unchanged in December, suggesting there is sufficient existing capacity in the non-oil sector to deal with current workloads.

Improved vendor response

Higher output requirements led firms to increase their purchasing activity in December. The rate of expansion was sharp and unchanged from that seen in November. Stocks of purchases also continued to rise, at a slightly weaker pace than seen in the previous month. As has been the case throughout the survey’s history to date, suppliers’ delivery times shortened in December. The latest improvement in vendor performance was marked, and attributed by respondents to requirements for faster deliveries.

Overall, the UAE PMI averaged 53.9 in 2016, down from 56.0 in 2015, signalling a slower rate of growth in the non-oil private sector last year.

“Looking ahead to 2017, higher oil prices should boost sentiment and reduce the pressure on the government’s budget. While we are not expecting a substantial fiscal stimulus this year, we also don’t foresee further cuts to spending. Construction and other Expo 2020 related spending should also pick up in 2017, supporting growth in the broader non-oil economy. Consequently, we expect real GDP growth to accelerate to 3.4 per cent this year from an estimated 3 per cent in 2016,” she said.