Dubai: The Gulf Cooperation Council (GCC) economies going through a period of transition of a new normal in the context of prolonged low oil prices is expected to start a new phase of recovery from 2018, according to ‘Economic Insight: Middle East Q4 2017’ report from the accountancy and finance body ICAEW, and economic forecaster Oxford Economics.

GCC gross domestic product (GDP) is expected to grow from just 0.3 per cent in 2017 to 2.8 per cent next year, and an acceleration from 1.4 per cent in 2017 to 3.2 per cent next year in the wider Middle East.

The public finances of GCC now look to be on a more sustainable path, thanks to factors such as the upcoming Value-Added Tax (VAT) and emergency austerity which saw public spending cut by almost 20 per cent from 2015-2017 at the GCC level.

With Opec-plus oil production cuts likely to be maintained through 2018, and reversed in 2019, GDP growth is expected to pick up to around 4 per cent in both the GCC and wider Middle East in 2019. Within this, GCC oil GDP is forecast to rebound from a 2.3 per cent contraction in 2017 to growth of 1.7 per cent in 2018 and around 1 percentage point stronger in 2019, the report stated.

“Economic growth prospects of the Middle East countries, particularly the GCC, are projected to improve in 2018 and the years after. But the political and security risks remain high and could limit or delay the recovery in the region,” said Tom Rogers, ICAEW Economic Advisor and Associate Director of Oxford Economics.

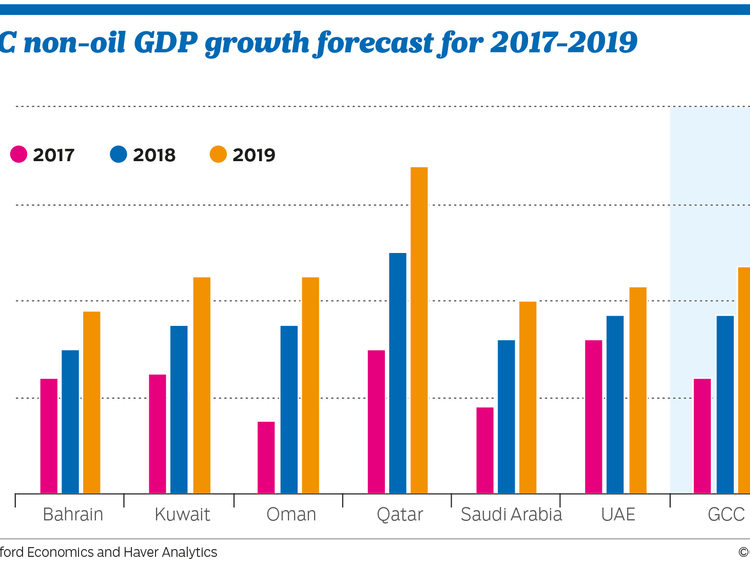

Growth in the GCC non-oil sector is forecast to pick up from 2.4 per cent in 2017 to 3.7 per cent in 2018 and 4.7 per cent the year after. Despite the strong growth outlook, analyst say the region faces high geopolitical risks.

Recent developments such as the missile attack from Yemen into Saudi Arabia has increased the risks increasing Iran-Saudi tensions. The dispute between Qatar and other GCC members has deteriorated. Although the direct economic impacts have so far been relatively modest, analysts say the strains could undermine regional cooperation on economic policy issues, and broader investor confidence in the region.

Reforms gain traction

While fiscal reforms across the GCC are gaining traction, 2018 will be a key year of transition for Saudi Arabia in several contexts. For the first time, Saudi citizens will pay VAT on the goods and services they buy, Saudi women will be permitted to drive, and private (and foreign) investors may be able to take a stake in Saudi Aramco. The Kingdom is at the start of a potentially decades-long process of economic diversification and social change, the report stated.

The recent improvement in oil prices is expected to improve fiscal space GCC and in particular it is expected to support public spending and growth in Saudi Arabia. In this context, Saudi Arabia is expected to play a key role in securing an extension of the Opec-plus deal at the November 30 meeting.

Saudi economy is expected to pick up from a 0.3 per cent contraction in 2017 (largely a result of lower oil output) to record growth of 2.3 per cent in 2018. As oil output is restored to pre-cut levels in 2019, GDP is expected to grow 3.8 per cent.

“Saudi Arabia is moving in the right direction with regards to economic reforms. There is clearly increasing momentum behind the shift towards a more market-driven economy in Saudi Arabia. But this shift will take some time and for the coming years the economy will remain heavily influenced by traditional growth drivers — the oil sector and the importance of government spending,” said Michael Armstrong, ICAEW Regional Director for the Middle East, Africa and South Asia (MEASA).