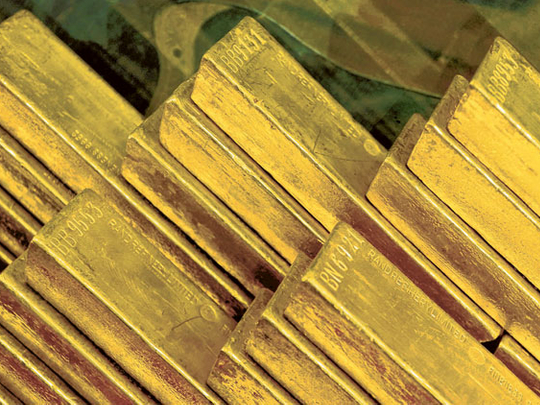

Abu Dhabi: Security agencies foiled an attempt to smuggle nearly 95 tonnes of gold and millions in cash into the country in a money laundering operation.

A criminal syndicate was planning to legalise the funds by channelling 94,410 kilograms of gold into the UAE banking system and then transferring it to neighbouring Arab and other countries.

The Ministry of Interior initiated coordinated action at land and air entry points to prevent the operation and apprehended members of the network.

According to sources from the Ministry of Interior, the plans were to smuggle the gold and money inside oil tankers from an African country, where it would be received by A.M.A., H.B. and A.A., who in turn would transfer the funds to truck drivers to transport it within the country.

The operation unfolded after the police arrested A.G.M. as he attempted to enter the country through the Ghuweifat checkpoint carrying 10 million Saudi riyals hidden in a truck.

Detailed investigation, monitoring and follow-up action provided the police with sufficient information to foil the plans of the culprits.

Last Thursday, Dubai authorities foiled an attempt to smuggle about 2 million counterfeit dollar notes.

The currency was hidden inside a large tea bag consignment transported by air from Kenya, and addressed to an Asian man living in Dubai.

In 2010, the Central Bank and Abu Dhabi police foiled four fraud and money laundering attempts totalling about Dh245 billion. The last such attempt was in June 2010 and involved a fraud attempt against a bank of $14.4 billion (Dh52 billion).

Tough deterrents

The UAE government has always recognised the importance of having strong laws to counter money laundering and terrorism financing.

Therefore, the UAE, through its Central Bank, issued various laws and regulations to the banking and financial system to tackle money laundering and combat terrorism financing. The UAE ensured the inclusion of anti-money laundering articles in its Federal Law No. (3) of 1987 and established a special unit for investigating fraud and suspicious transactions in July 1998, which was names ‘Anti-Money Laundering and Suspicious Cases Unit' in November 2000.

The Unit has access to all relevant authorities in the UAE and abroad and cooperates with the National Anti- Money Laundering Committee, the UAE Customs Authority, the Secretariat General of Municipalities, and a representative of Dubai Economic Development Department, Securities and Commodities Authority, the Federation of Chambers of Commerce and Industries and the concerned authorities and other concerned authorities.

— By Shehab Al Makahleh, Staff Reporter